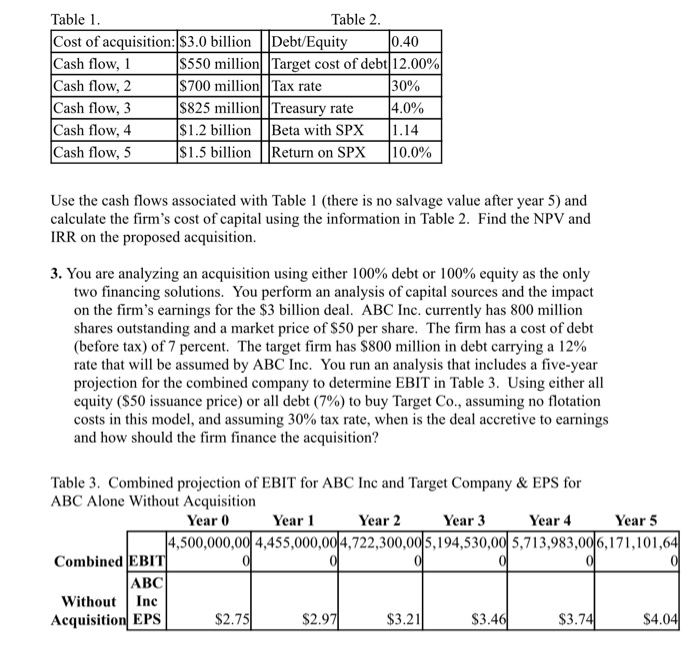

Question: Please show me how to solve #3. Thanks! Table 1 Cost of acquisition: $3.0 billion Debt/Equity Cash flow, 1 Cash flow, 2 Cash flow, 3

Table 1 Cost of acquisition: $3.0 billion Debt/Equity Cash flow, 1 Cash flow, 2 Cash flow, 3 Cash flow, 4 Cash flow, 5 Table 2 0.40 $550 million! Target cost of debt|12.00% $700 million Tax rate 30% 0% S825 ln Treasury rate $1.2 billion Beta with SPX 1.14 $1.5 billion l Return on SPX | 10.0% Use the cash flows associated with Table 1 (there is no salvage value after year 5) and calculate the firm's cost of capital using the information in Table 2. Find the NPV and IRR on the proposed acquisition. 3. You are analyzing an acquisition using either 100% debt or 100% equity as the only two financing solutions. You perform an analysis of capital sources and the impact on the firm's earnings for the $3 billion deal. ABC Inc. currently has 800 million shares outstanding and a market price of $50 per share. The firm has a cost of debt (before tax) of 7 percent. The target firm has $800 million in debt carrying a 12% rate that will be assumed by ABC Inc. You run an analysis that includes a five-year projection for the combined company to determine EBIT in Table 3. Using either all equity ($50 issuance price) or all debt (7%) to buy Target Co., assuming no flotation costs in this model, and assuming 30% tax rate, when is the deal accretive to earnings and how should the firm finance the acquisition? Table 3. Combined projection of EBIT for ABC Inc and Target Company & EPS for ABC Alone Without Acquisition Year 0 4,500,000,00| 4.455,000.00 4722,300,0015, 194,530,00| 5,71 3983,0%. I 71, 101 ,6 Year 1 Year 2 Year 3 Year 4 Year 5 Combined EBIT ABC Without Inc Acquisition EPS $2.75 S2.9 $3.21 S3.46 S3.7 S4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts