Question: Please show the following problem in excel format with detail instruction. Thank you You own a portfolio consisting of the stocks below: Stock or Security

Please show the following problem in excel format with detail instruction. Thank you

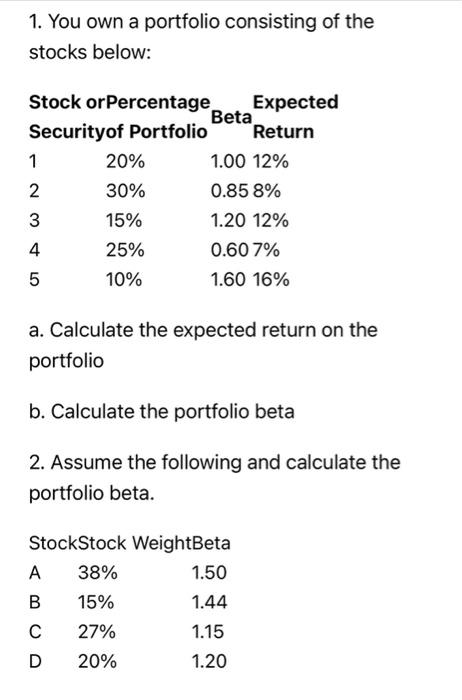

- You own a portfolio consisting of the stocks below:

| Stock or Security | Percentage of Portfolio | Beta | Expected Return |

| 1 | 20% | 1.00 | 12% |

| 2 | 30% | 0.85 | 8% |

| 3 | 15% | 1.20 | 12% |

| 4 | 25% | 0.60 | 7% |

| 5 | 10% | 1.60 | 16% |

The risk-free rate is 3%. Also, the expected return on the market portfolio is 11%.

a. Calculate the expected return of your (Hint: The expected return of a portfolio equals the weighted average of the individual stocks expected returns, where the weights are the percentage invested in each stock.)

b. Calculate the portfolio

- Assume you have the following

| Stock | Stock Weight | Beta |

| A | 38% | 1.50 |

| B | 15% | 1.44 |

| C | 27% | 1.15 |

| D | 20% | 1.20 |

- What is the portfolios beta?

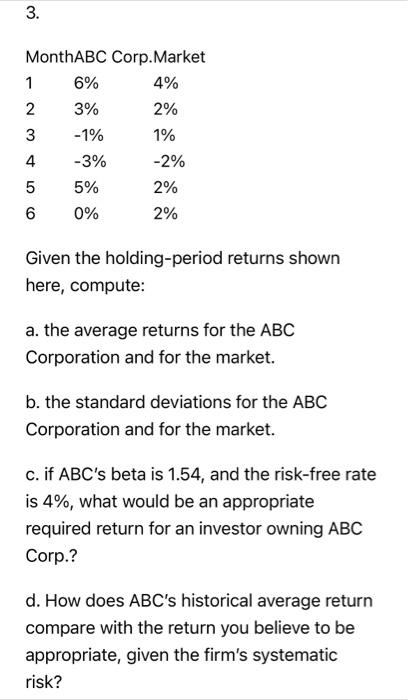

a. Given the holding-period returns shown here, compute the average returns and the standard deviations for the ABC Corporation and for the market.

| Month | ABC Corp. | Market |

| 1 | 6% | 4% |

| 2 | 3% | 2% |

| 3 | -1% | 1% |

| 4 | -3% | -2% |

| 5 | 5% | 2% |

| 6 | 0% | 2% |

b. If ABCs beta is 1.54, and the risk-free rate is 4%, what would be an appropriate required return for an investor owning ABC Corp.? (Note: Because the returns of ABC Corporation are based on monthly data, you will need to annualize the returns to make them compatible with the risk-free rate. For simplicity, you can convert from monthly to yearly returns by multiplying the average monthly returns by )

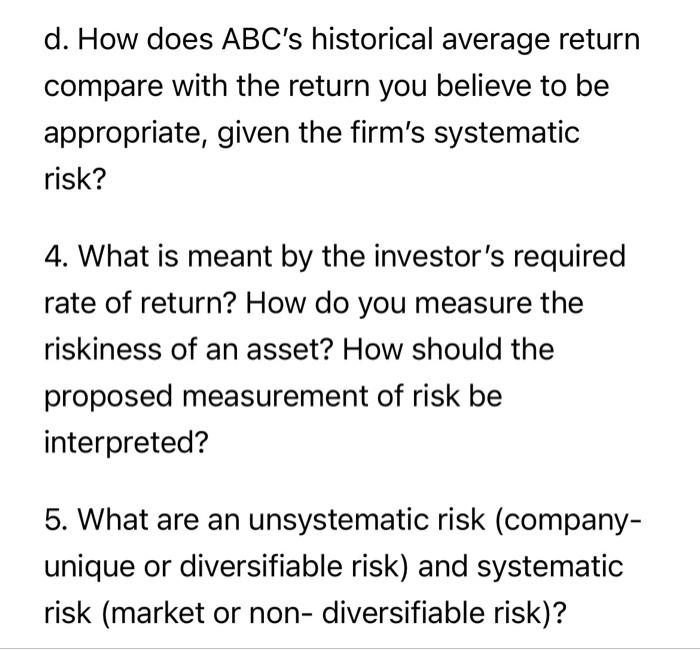

c. How does ABCs historical average return compare with the return you believe to be appropriate, given the firms systematic risk?

- What is meant by the investors required rate of return? How do you measure the riskiness of an asset? How should the proposed measurement of risk be interpreted?

- What are an unsystematic risk (company-unique or diversifiable risk) and systematic risk (market or non- diversifiable risk)?

1. You own a portfolio consisting of the stocks below: a. Calculate the expected return on the portfolio b. Calculate the portfolio beta 2. Assume the following and calculate the portfolio beta. 3. Given the holding-period returns shown here, compute: a. the average returns for the ABC Corporation and for the market. b. the standard deviations for the ABC Corporation and for the market. c. if ABC s beta is 1.54, and the risk-free rate is 4%, what would be an appropriate required return for an investor owning ABC Corp.? d. How does ABC 's historical average return compare with the return you believe to be appropriate, given the firm's systematic risk? d. How does ABC s historical average return compare with the return you believe to be appropriate, given the firm's systematic risk? 4. What is meant by the investor's required rate of return? How do you measure the riskiness of an asset? How should the proposed measurement of risk be interpreted? 5. What are an unsystematic risk (companyunique or diversifiable risk) and systematic risk (market or non- diversifiable risk)? 1. You own a portfolio consisting of the stocks below: a. Calculate the expected return on the portfolio b. Calculate the portfolio beta 2. Assume the following and calculate the portfolio beta. 3. Given the holding-period returns shown here, compute: a. the average returns for the ABC Corporation and for the market. b. the standard deviations for the ABC Corporation and for the market. c. if ABC s beta is 1.54, and the risk-free rate is 4%, what would be an appropriate required return for an investor owning ABC Corp.? d. How does ABC 's historical average return compare with the return you believe to be appropriate, given the firm's systematic risk? d. How does ABC s historical average return compare with the return you believe to be appropriate, given the firm's systematic risk? 4. What is meant by the investor's required rate of return? How do you measure the riskiness of an asset? How should the proposed measurement of risk be interpreted? 5. What are an unsystematic risk (companyunique or diversifiable risk) and systematic risk (market or non- diversifiable risk)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts