Question: Please show work and excel. You are given a capital project that generates the Cash Flows listed below. In order the execute this project, you

Please show work and excel.

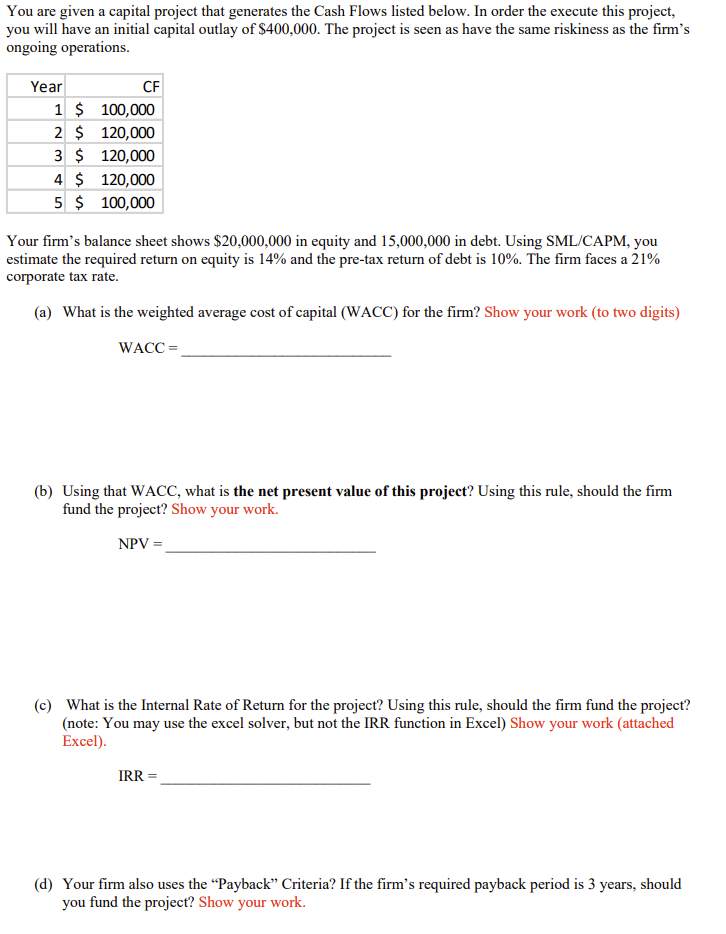

You are given a capital project that generates the Cash Flows listed below. In order the execute this project, you will have an initial capital outlay of $400,000. The project is seen as have the same riskiness as the firm's ongoing operations. Year CF 1 $ 100,000 2 $ 120,000 3 $ 120,000 4 $ 120,000 5 $ 100,000 Your firm's balance sheet shows $20,000,000 in equity and 15,000,000 in debt. Using SML/CAPM, you estimate the required return on equity is 14% and the pre-tax return of debt is 10%. The firm faces a 21% corporate tax rate. (a) What is the weighted average cost of capital (WACC) for the firm? Show your work (to two digits) WACC = (b) Using that WACC, what is the net present value of this project? Using this rule, should the firm fund the project? Show your work. NPV = c) What is the Internal Rate of Return for the project? Using this rule, should the firm fund the project? (note: You may use the excel solver, but not the IRR function in Excel) Show your work (attached Excel). IRR (d) Your firm also uses the Payback Criteria? If the firm's required payback period is 3 years, should you fund the project? Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts