Question: please solve it in 10 mins I will thumb you up please please 10 mins I have please 215 Question 33 O IV. ving to

please solve it in 10 mins I will thumb you up please please 10 mins I have please

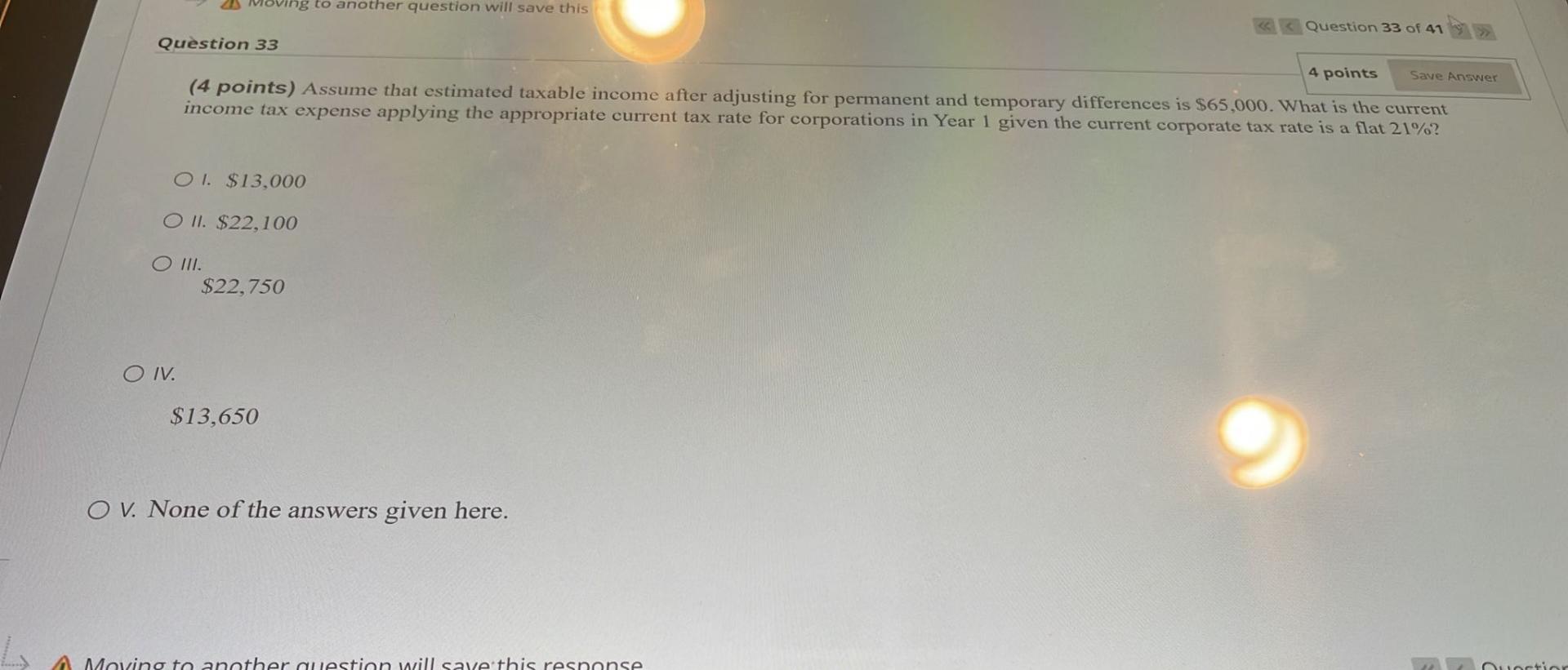

215 Question 33 O IV. ving to another question will save this OI. $13,000 O II. $22,100 O III. 4 points Save Answer (4 points) Assume that estimated taxable income after adjusting for permanent and temporary differences is $65,000. What is the current income tax expense applying the appropriate current tax rate for corporations in Year 1 given the current corporate tax rate is a flat 21%? $22,750 $13,650 OV. None of the answers given here. Question 33 of 41 A Moving to another question will save this response Quortior

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts