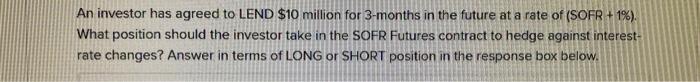

Question: Please solve. Please show your work. Please explain your reasoning. An investor has agreed to LEND $10 million for 3-months in the future at a

An investor has agreed to LEND $10 million for 3-months in the future at a rate of (SOFR + 1%). What position should the investor take in the SOFR Futures contract to hedge against interest rate changes? Answer in terms of LONG or SHORT position in the response box below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts