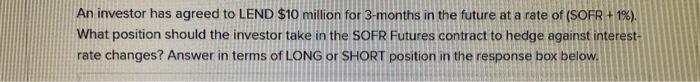

Question: Please solve. Please show your work. Please explain your reasoning. An investor has agreed to LEND $10 million for 3-months in the future at a

An investor has agreed to LEND $10 million for 3-months in the future at a rate of (SOFR + 1%). What position should the investor take in the SOFR Futures contract to hedge against interest- rate changes? Answer in terms of LONG or SHORT position in the response box below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts