Question: please solve this question according to this answer sheet delow below with compitation. Mighty Machinery purchased a machine on January 2, 2018, for $500,000. The

please solve this question according to this answer sheet delow below with compitation.

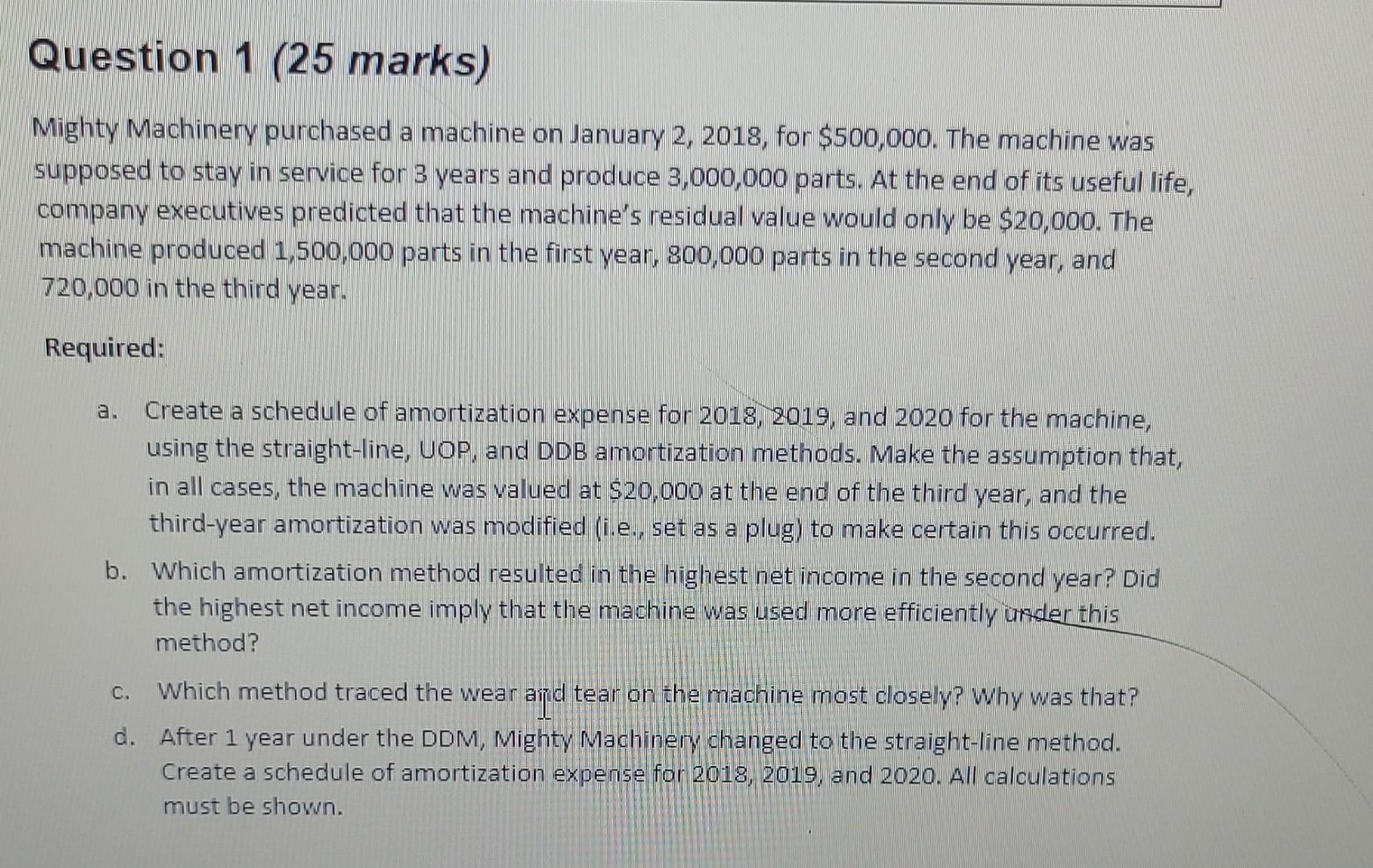

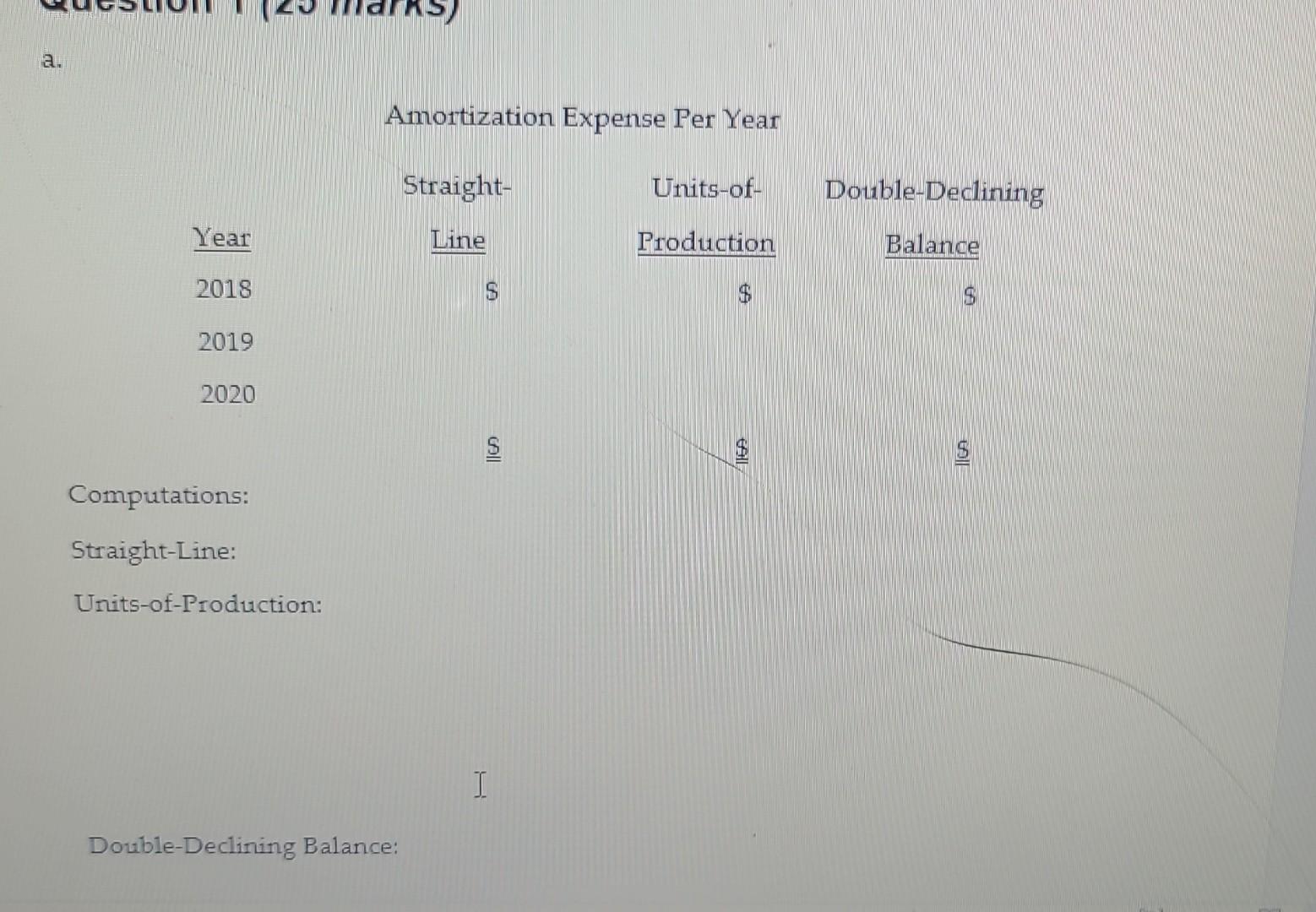

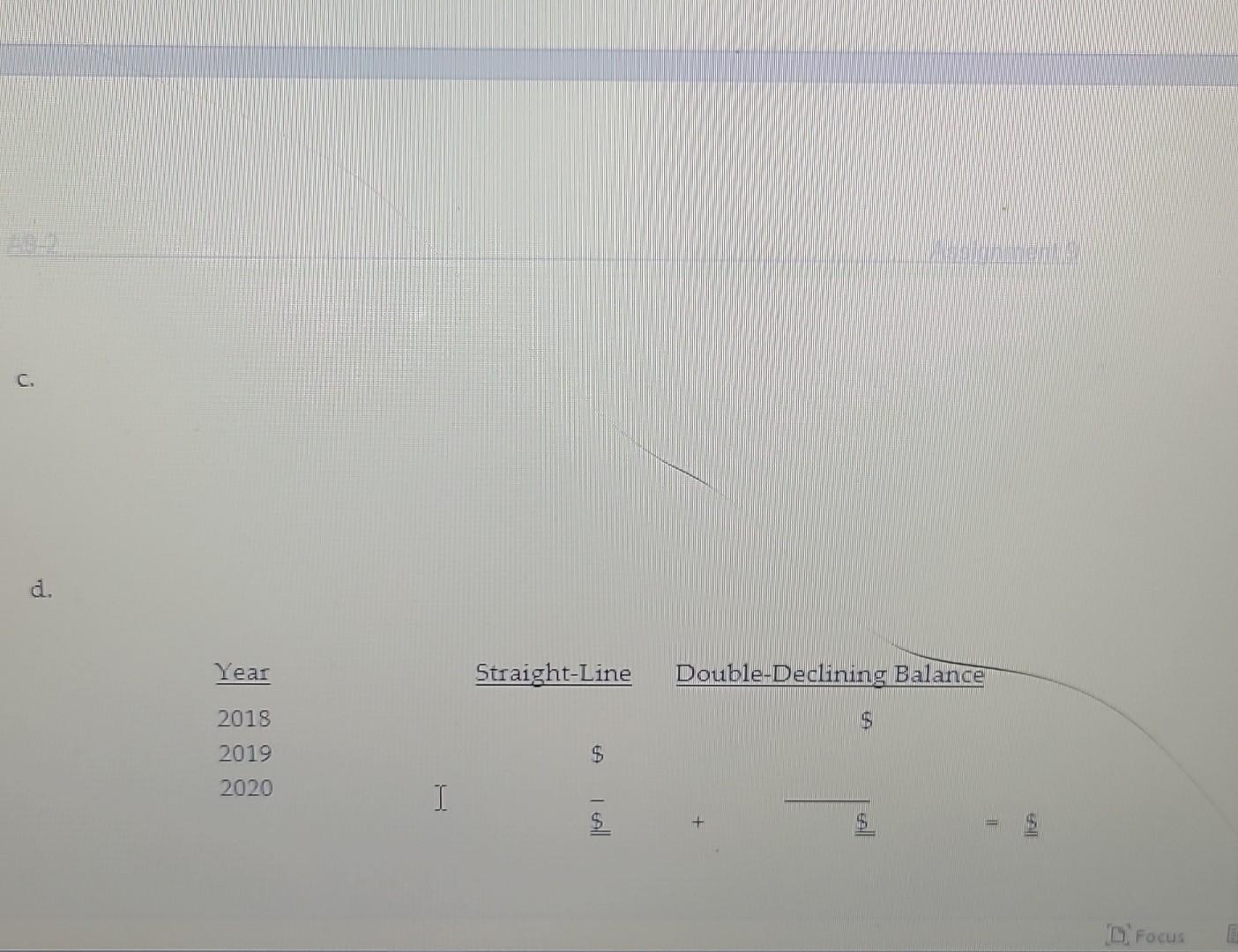

Mighty Machinery purchased a machine on January 2, 2018, for $500,000. The machine was supposed to stay in service for 3 years and produce 3,000,000 parts. At the end of its useful life, company executives predicted that the machine's residual value would only be $20,000. The machine produced 1,500,000 parts in the first year, 800,000 parts in the second year, and 720,000 in the third year. Required: a. Create a schedule of amortization expense for 2018,2019 , and 2020 for the machine, using the straight-line, UOP, and DDB amortization methods. Make the assumption that, in all cases, the machine was valued at $20,000 at the end of the third year, and the third-year amortization was modified (i.e., set as a plug) to make certain this occurred. b. Which amortization method resulted in the highest net income in the second year? Did the highest net income imply that the machine was used more efficiently under this method? c. Which method traced the wear aiid tear on the machine most closely? Why was that? d. After 1 year under the DDM, Mighty Machinery changed to the straight-line method. Create a schedule of amortization expense for 2018, 2019, and 2020. All calculations must be shown. Amortization Expense Per Year Computations: Straight-Line: Units-of-Production: Double-Declining Balance: c. d. Year 2018 2019 2020 Straight-Line $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts