Question: please solve using excel functions You currently make $70,000 a year and expect your salary to increase by 3% a year for 20 years. You

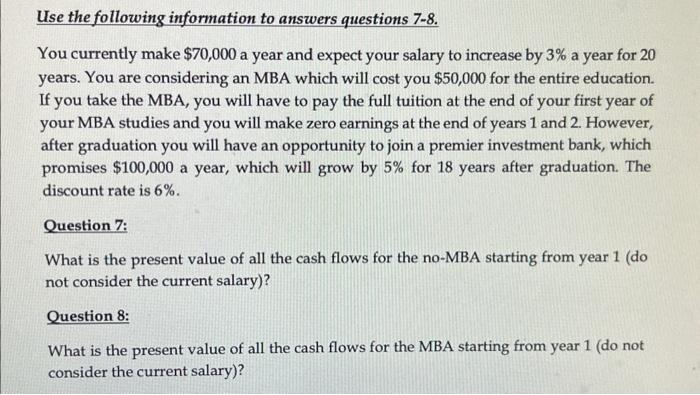

You currently make $70,000 a year and expect your salary to increase by 3% a year for 20 years. You are considering an MBA which will cost you $50,000 for the entire education. If you take the MBA, you will have to pay the full tuition at the end of your first year of your MBA studies and you will make zero earnings at the end of years 1 and 2 . However, after graduation you will have an opportunity to join a premier investment bank, which promises $100,000 a year, which will grow by 5% for 18 years after graduation. The discount rate is 6%. Question 7: What is the present value of all the cash flows for the no-MBA starting from year 1 (do not consider the current salary)? Question 8: What is the present value of all the cash flows for the MBA starting from year 1 (do not consider the current salary)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts