Question: please type the answer by computer, so i can see it clearly, thank you!!! (a) Your investment advisor expects that interest rate will fall due

please type the answer by computer, so i can see it clearly, thank you!!!

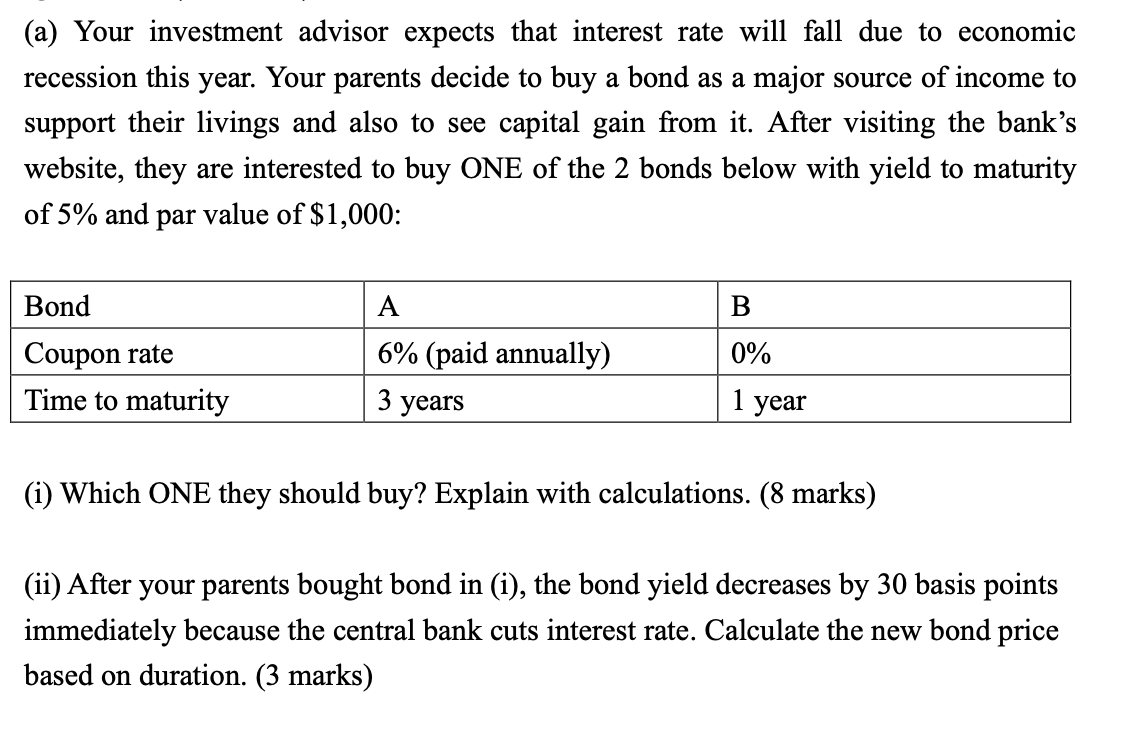

(a) Your investment advisor expects that interest rate will fall due to economic recession this year. Your parents decide to buy a bond as a major source of income to support their livings and also to see capital gain from it. After visiting the bank's website, they are interested to buy ONE of the 2 bonds below with yield to maturity of 5% and par value of $1,000: Bond A B 0% Coupon rate Time to maturity 6% (paid annually) 3 years 1 year (i) Which ONE they should buy? Explain with calculations. (8 marks) (ii) After your parents bought bond in (i), the bond yield decreases by 30 basis points immediately because the central bank cuts interest rate. Calculate the new bond price based on duration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts