Question: please type the answer by computer, so i can see it clearly, thank you!!! Because of the economic downturn, your financial advisor predicts interest rates

please type the answer by computer, so i can see it clearly, thank you!!!

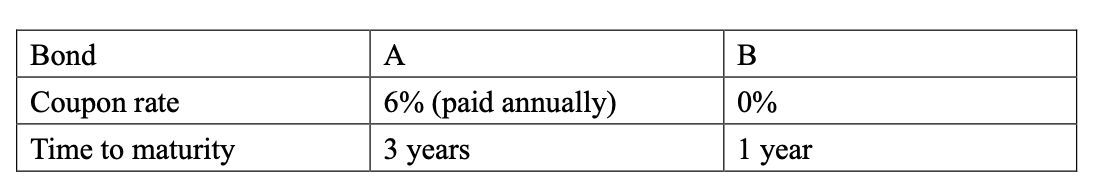

Because of the economic downturn, your financial advisor predicts interest rates to decline this year. Your parents decide to acquire a bond as a main source of income as well as a way to profit from the investment. After visiting the banks website, they are interested to buy ONE of the 2 bonds below with yield to maturity of 5% and par value of $1,000:

Question:

1(a) You will further your studies on postgraduate degree in Fintech. Your parents need to pay $550,000, $600,000 and $650,000 at the end of next 3 years respectively.

1(b) If the market interest rate is 4% per annum, what will be the duration of the payment obligation?

A B Bond Coupon rate Time to maturity 0% 6% (paid annually) 3 years 1 year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts