Question: please urgent ( answer a,b,c) please Integrative - Pisk and valuation Glant Enteprises' alock has a required retsm of 12.4. The compary. Which pland to

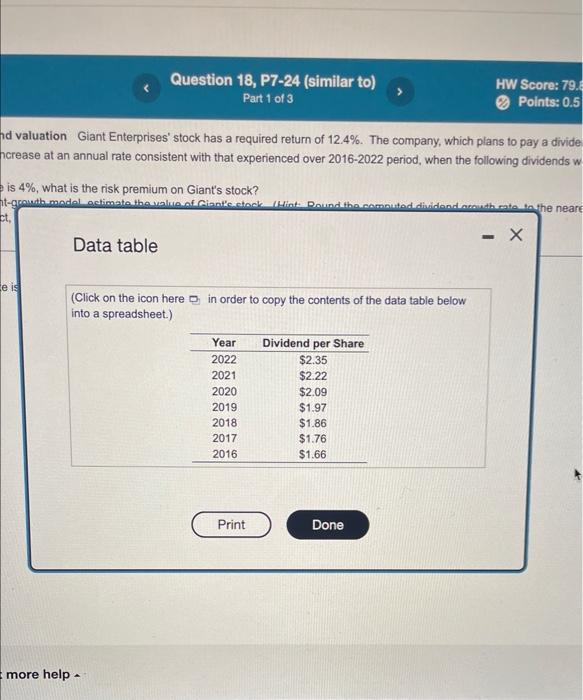

Integrative - Pisk and valuation Glant Enteprises' alock has a required retsm of 12.4. The compary. Which pland to pay a dividend of 52.49 per share in the ooming year, anfopates that its future dividendi wit increase at an arnual rale corsiatent with that experienced over 2016.2022 period, when the following dindends were paid a. If the risk-free rale li 4%, what is seve risk premium on Giants sock? b. Upng the constant-groath model, estmate the value of Giarts stock. (Hirt. Round the computed dondend growh rate to the nearest whole percent) c. Fxplsin what effect, if anx a decreate in the risk ptemium would hove on the value of Clarit alock. a. If the roktree rate is 4 th, the risk premem on Cians siock is S. (Acund to one decimal place.) d valuation Giant Enterprises' stock has a required return of 12.4%. The company, which plans to pay a divide crease at an annual rate consistent with that experienced over 2016-2022 period, when the following dividends is 4%, what is the risk premium on Giant's stock? Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) a. If the risk-free rate is 4%, what is the risk premium on Giants stock? b. Using the constant-growth model, estimate the value of Giant's stock. (Hint: Round the computed dividend growth rate to the nearest whole percent.) c. Explain what effect, if any, a decrease in the risk premium would have on the value of Giant's stock. a. If the risk-tree rate is 4%, the risk premium on Giant's stock is %. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts