Question: Please use excel and show formulas For a residential building project, the developer has estimated the capital investment, net rental revenue, and resale value after

Please use excel and show formulas

Please use excel and show formulas

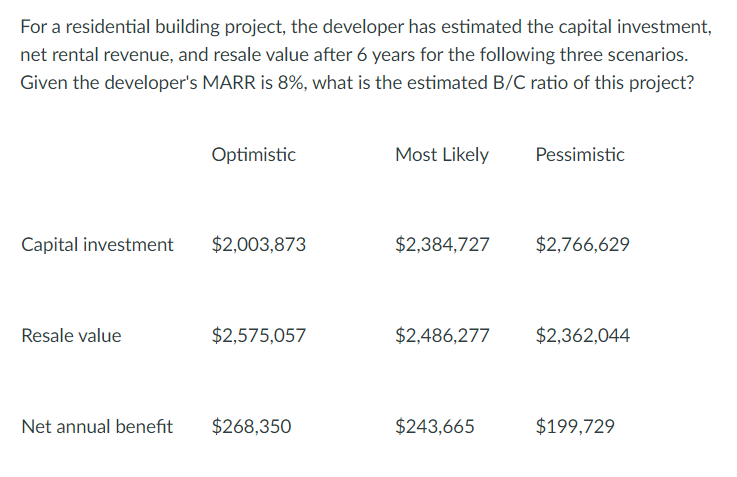

For a residential building project, the developer has estimated the capital investment, net rental revenue, and resale value after 6 years for the following three scenarios. Given the developer's MARR is 8%, what is the estimated B/C ratio of this project? Optimistic Most Likely Pessimistic Capital investment $2,003,873 $2,384,727 $2,766,629 Resale value $2,575,057 $2,486,277 $2,362,044 Net annual benefit $268,350 $243,665 $199,729 For a residential building project, the developer has estimated the capital investment, net rental revenue, and resale value after 6 years for the following three scenarios. Given the developer's MARR is 8%, what is the estimated B/C ratio of this project? Optimistic Most Likely Pessimistic Capital investment $2,003,873 $2,384,727 $2,766,629 Resale value $2,575,057 $2,486,277 $2,362,044 Net annual benefit $268,350 $243,665 $199,729

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts