Question: please use excel to help me solve this. thank you!!! F D E G H 4. Consider the alternatives A, B, and C with the

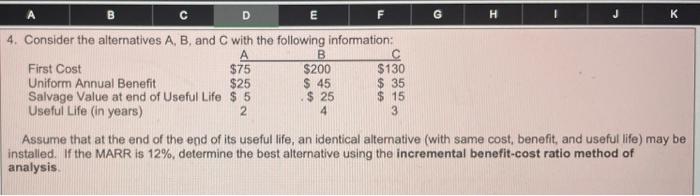

F D E G H 4. Consider the alternatives A, B, and C with the following information: A B First Cost $75 $200 $130 Uniform Annual Benefit $25 $ 45 $ 35 Salvage Value at end of Useful Life $ 5 .$ 25 $ 15 Useful Life (in years) 2 4 3 Assume that at the end of the end of its useful life, an identical alternative (with same cost, benefit, and useful life) may be installed. If the MARR is 12%, determine the best alternative using the incremental benefit-cost ratio method of analysis F D E G H 4. Consider the alternatives A, B, and C with the following information: A B First Cost $75 $200 $130 Uniform Annual Benefit $25 $ 45 $ 35 Salvage Value at end of Useful Life $ 5 .$ 25 $ 15 Useful Life (in years) 2 4 3 Assume that at the end of the end of its useful life, an identical alternative (with same cost, benefit, and useful life) may be installed. If the MARR is 12%, determine the best alternative using the incremental benefit-cost ratio method of analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts