Question: plz help Assignment: Using the balance sheet and income statement data on FOLLOWING PAGES , compute Return on assets, Return on equity, Net interest margin,

plz help

plz help

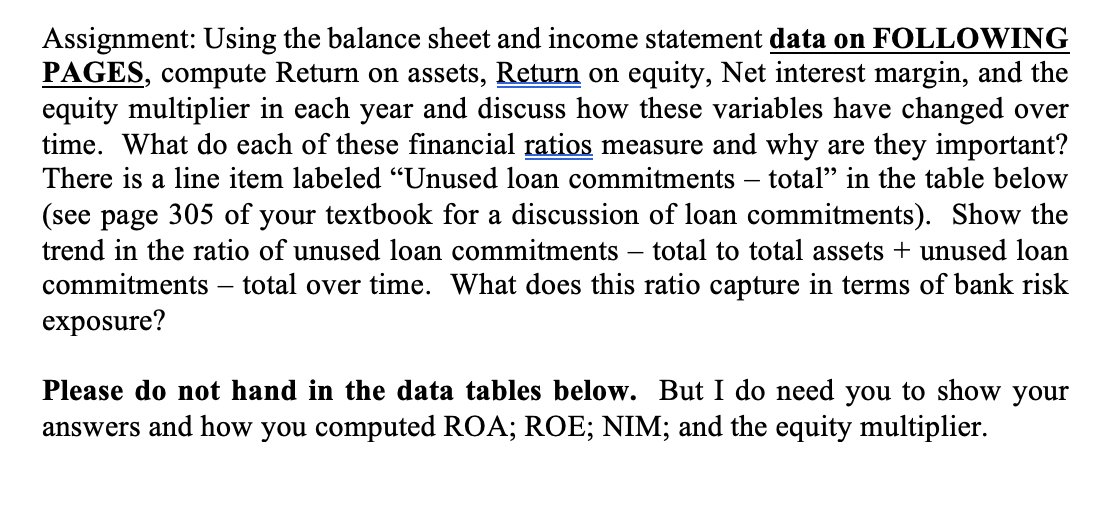

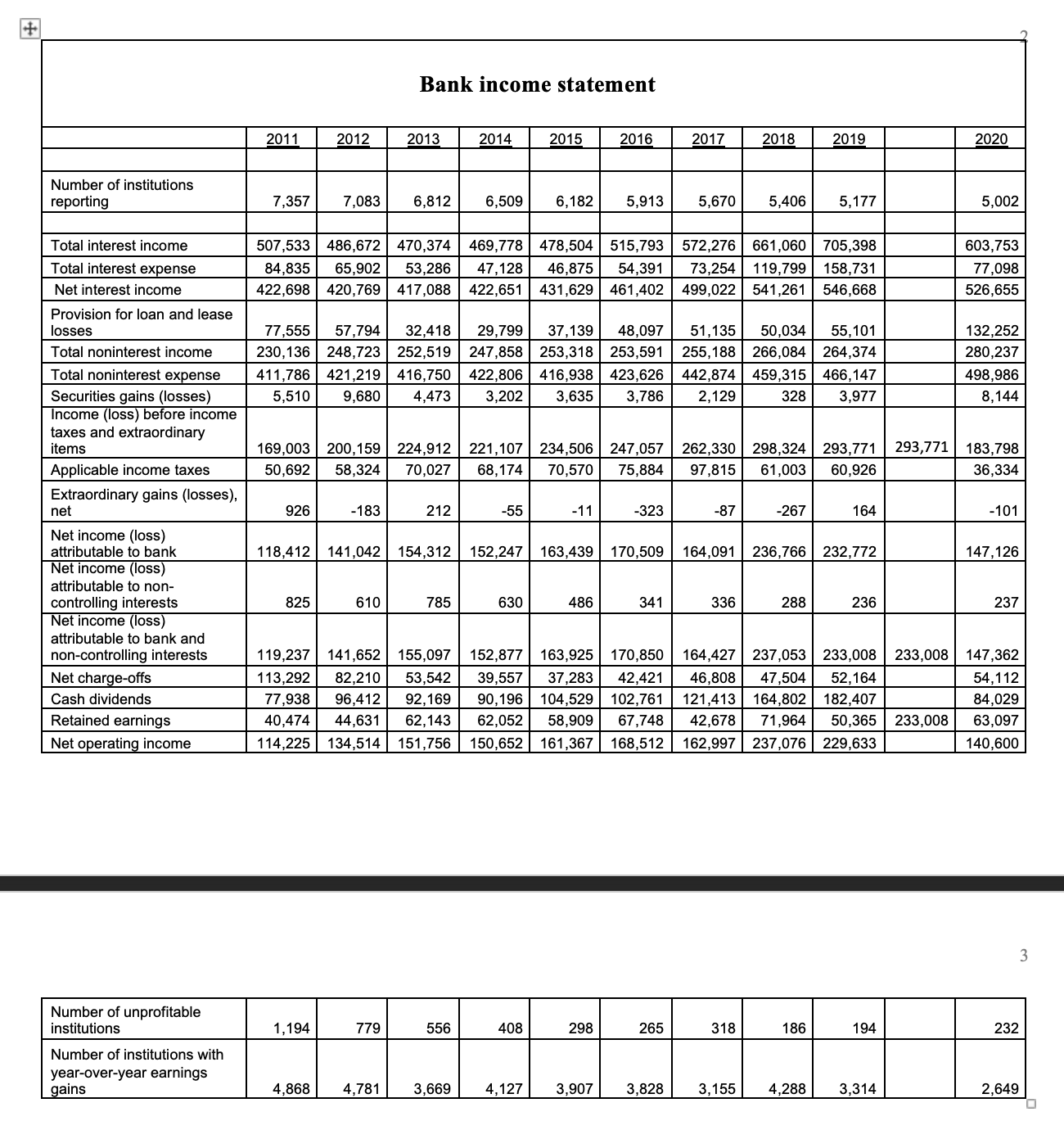

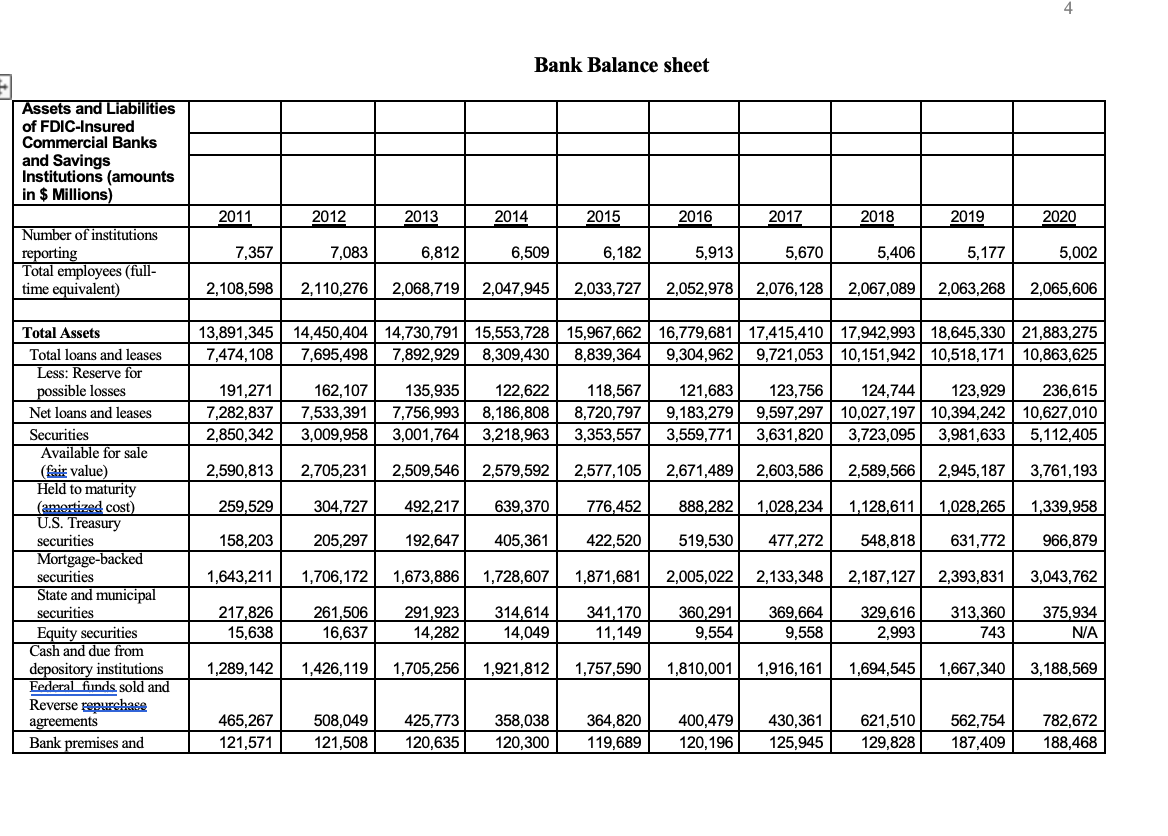

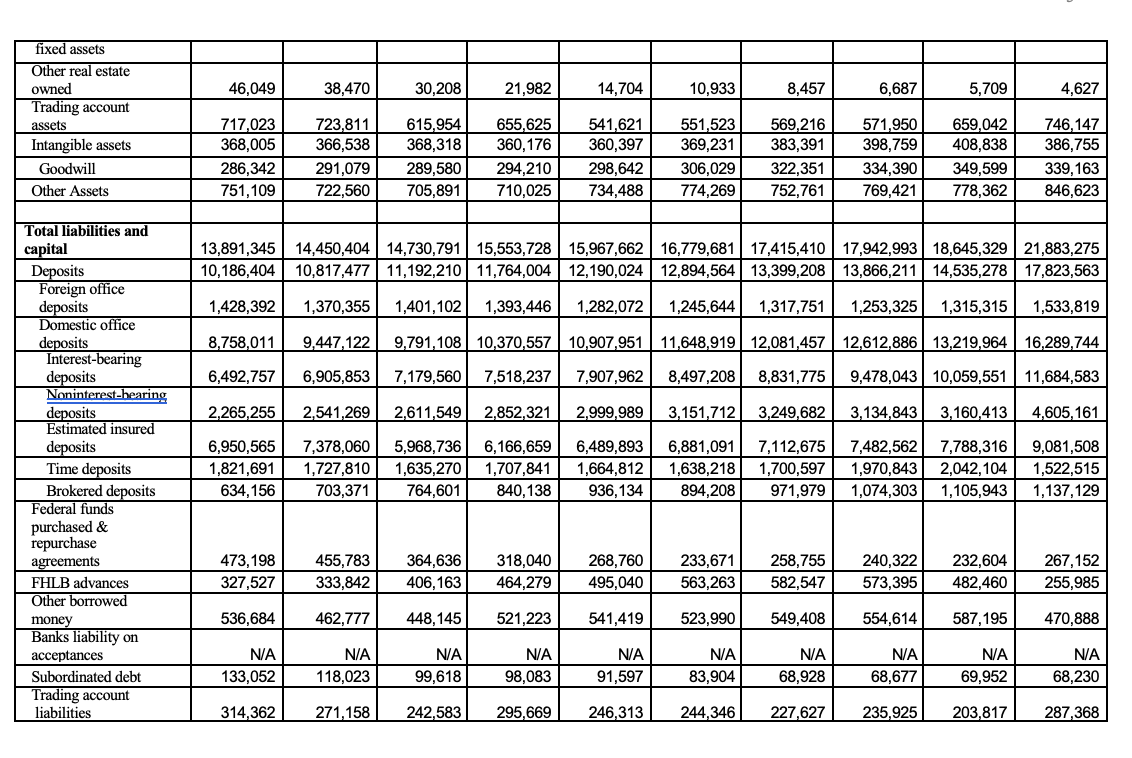

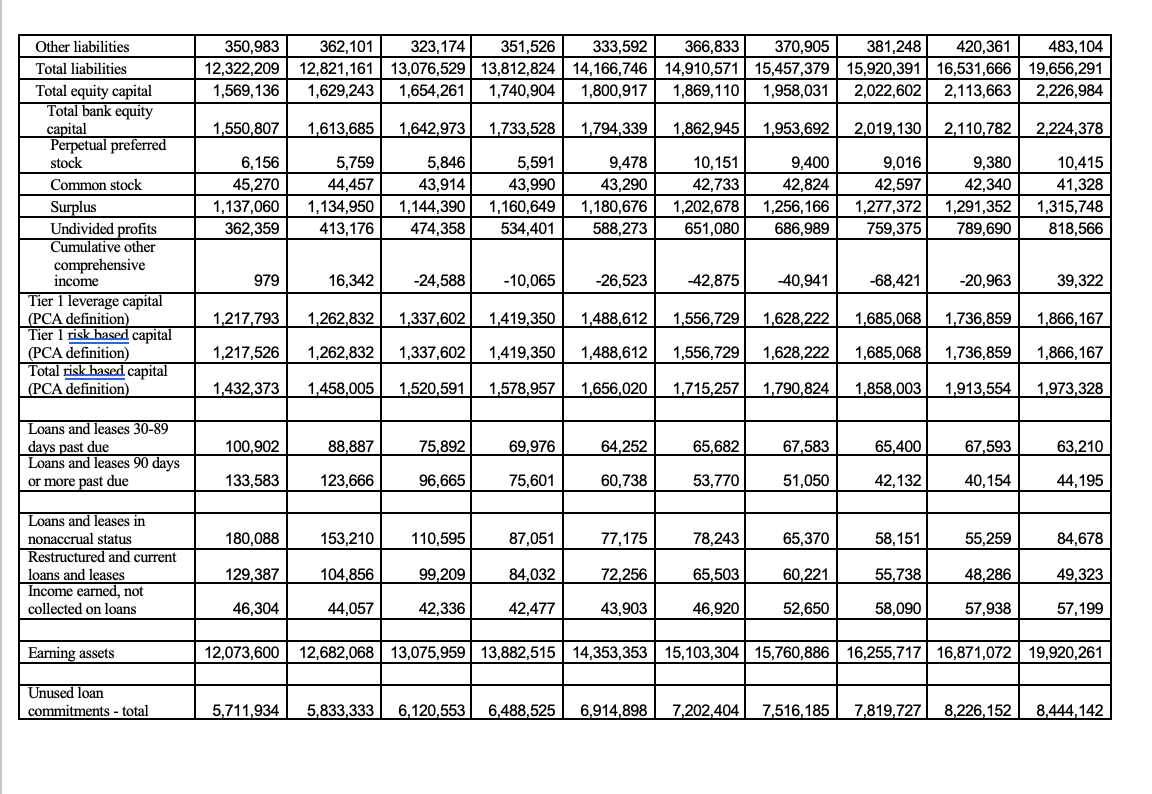

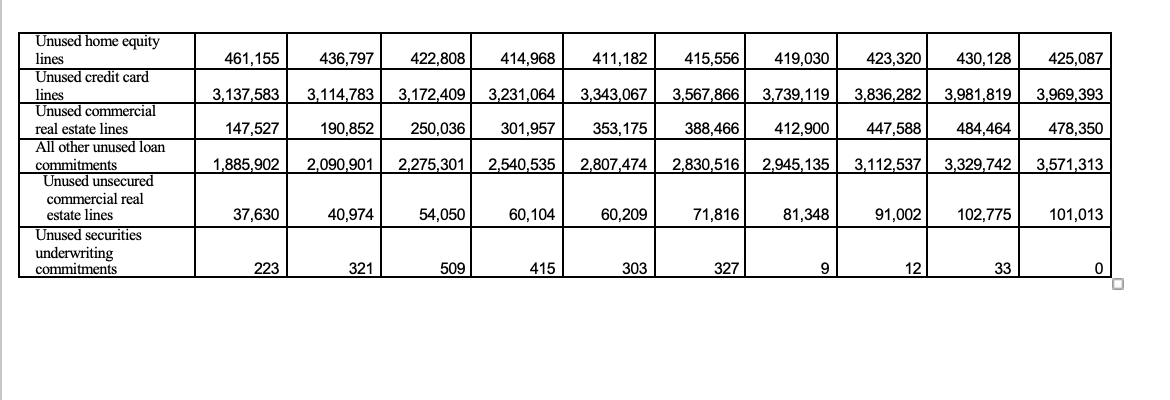

Assignment: Using the balance sheet and income statement data on FOLLOWING PAGES , compute Return on assets, Return on equity, Net interest margin, and the equity multiplier in each year and discuss how these variables have changed over time. What do each of these financial ratios measure and why are they important? There is a line item labeled "Unused loan commitments - total" in the table below (see page 305 of your textbook for a discussion of loan commitments). Show the trend in the ratio of unused loan commitments - total to total assets + unused loan commitments - total over time. What does this ratio capture in terms of bank risk exposure? Please do not hand in the data tables below. But I do need you to show your answers and how you computed ROA; ROE; NIM; and the equity multiplier. Bank income statement Bank Balance sheet Assignment: Using the balance sheet and income statement data on FOLLOWING PAGES , compute Return on assets, Return on equity, Net interest margin, and the equity multiplier in each year and discuss how these variables have changed over time. What do each of these financial ratios measure and why are they important? There is a line item labeled "Unused loan commitments - total" in the table below (see page 305 of your textbook for a discussion of loan commitments). Show the trend in the ratio of unused loan commitments - total to total assets + unused loan commitments - total over time. What does this ratio capture in terms of bank risk exposure? Please do not hand in the data tables below. But I do need you to show your answers and how you computed ROA; ROE; NIM; and the equity multiplier. Bank income statement Bank Balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts