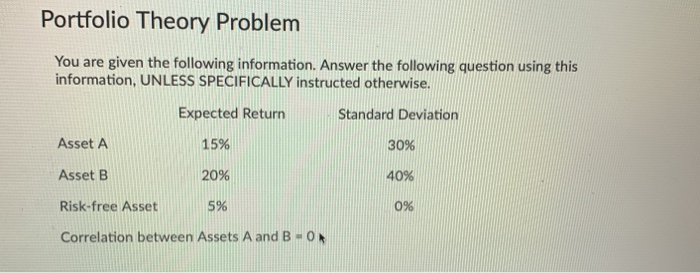

Question: Portfolio Theory Problem You are given the following information. Answer the following question using this information, UNLESS SPECIFICALLY instructed otherwise. Expected Return Standard Deviation Asset

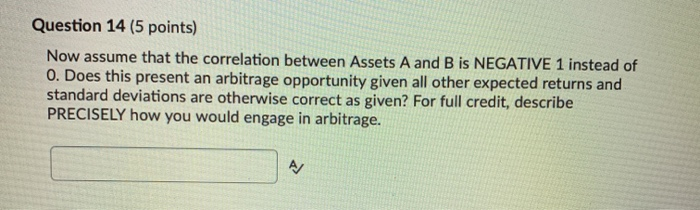

Portfolio Theory Problem You are given the following information. Answer the following question using this information, UNLESS SPECIFICALLY instructed otherwise. Expected Return Standard Deviation Asset A 15% 30% Asset B 20% 40% Risk-free Asset 5% 0% Correlation between Assets A and B -0 Question 14 (5 points) Now assume that the correlation between Assets A and B is NEGATIVE 1 instead of 0. Does this present an arbitrage opportunity given all other expected returns and standard deviations are otherwise correct as given? For full credit, describe PRECISELY how you would engage in arbitrage

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock