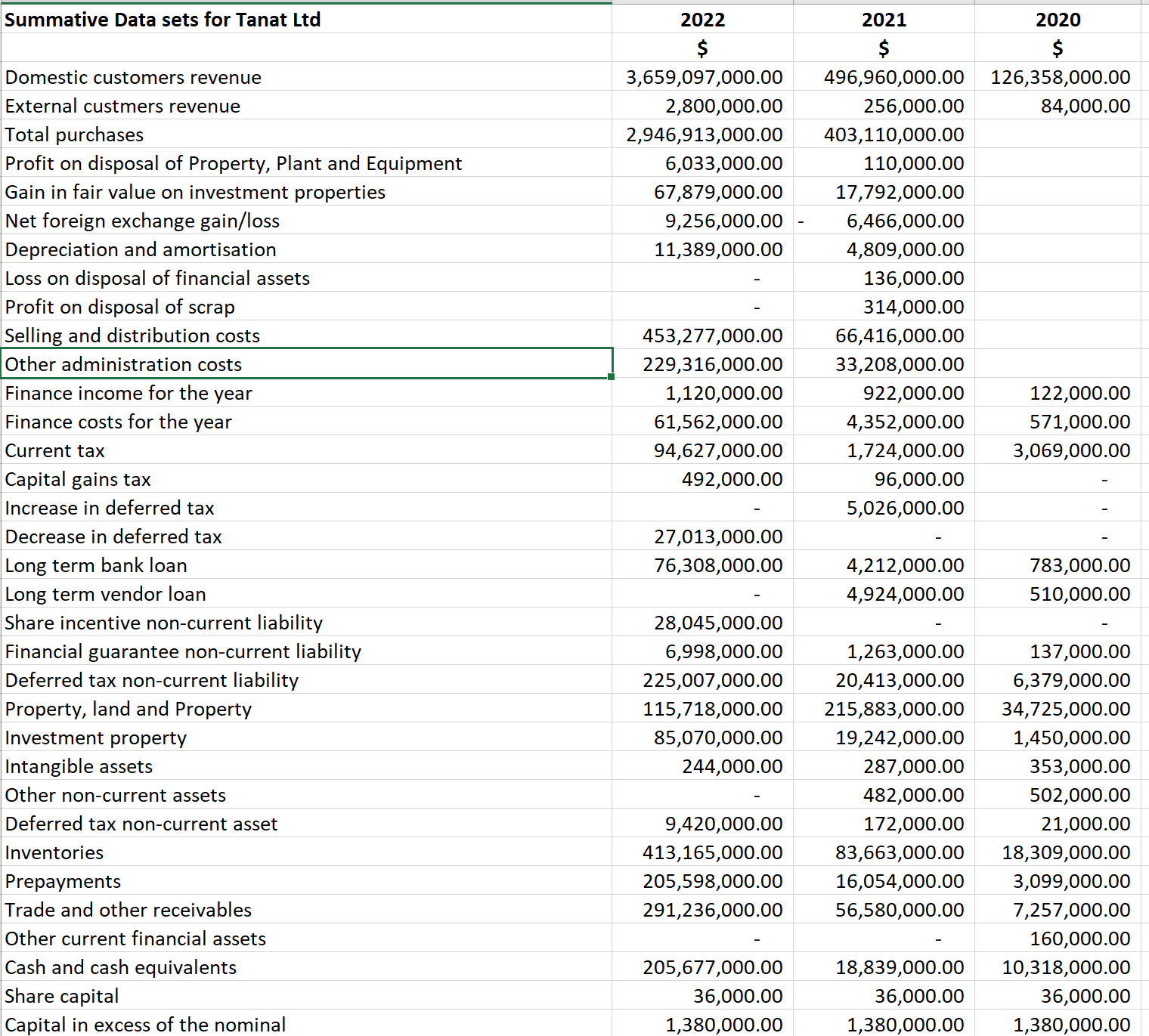

Question: Prepare 3 statement model for 2021 and 2022 from the financials given below: begin{tabular}{|c|c|c|c|} hline Summative Data sets for Tanat Ltd & 2022 & 2021

Prepare 3 statement model for 2021 and 2022 from the financials given below:

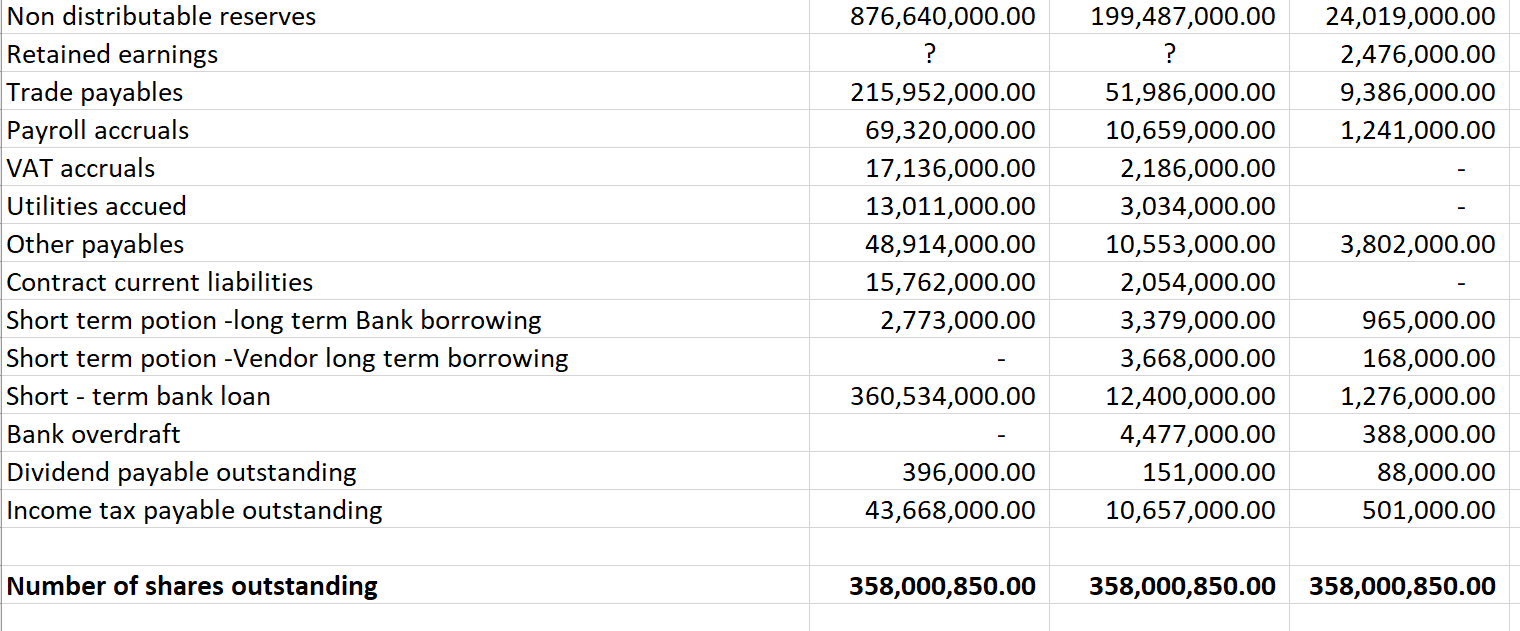

\begin{tabular}{|c|c|c|c|} \hline Summative Data sets for Tanat Ltd & 2022 & 2021 & 2020 \\ \hline & $ & $ & $ \\ \hline Domestic customers revenue & 3,659,097,000.00 & 496,960,000.00 & 126,358,000.00 \\ \hline External custmers revenue & 2,800,000.00 & 256,000.00 & 84,000.00 \\ \hline Total purchases & 2,946,913,000.00 & 403,110,000.00 & \\ \hline Profit on disposal of Property, Plant and Equipment & 6,033,000.00 & 110,000.00 & \\ \hline Gain in fair value on investment properties & 67,879,000.00 & 17,792,000.00 & \\ \hline Net foreign exchange gain/loss & 9,256,000.00 & 6,466,000.00 & \\ \hline Depreciation and amortisation & 11,389,000.00 & 4,809,000.00 & \\ \hline Loss on disposal of financial assets & - & 136,000.00 & \\ \hline Profit on disposal of scrap & - & 314,000.00 & \\ \hline Selling and distribution costs & 453,277,000.00 & 66,416,000.00 & \\ \hline Other administration costs & 229,316,000.00 & 33,208,000.00 & \\ \hline Finance income for the year & 1,120,000.00 & 922,000.00 & 122,000.00 \\ \hline Finance costs for the year & 61,562,000.00 & 4,352,000.00 & 571,000.00 \\ \hline Current tax & 94,627,000.00 & 1,724,000.00 & 3,069,000.00 \\ \hline Capital gains tax & 492,000.00 & 96,000.00 & - \\ \hline Increase in deferred tax & - & 5,026,000.00 & - \\ \hline Decrease in deferred tax & 27,013,000.00 & - & - \\ \hline Long term bank loan & 76,308,000.00 & 4,212,000.00 & 783,000.00 \\ \hline Long term vendor loan & - & 4,924,000.00 & 510,000.00 \\ \hline Share incentive non-current liability & 28,045,000.00 & - & - \\ \hline Financial guarantee non-current liability & 6,998,000.00 & 1,263,000.00 & 137,000.00 \\ \hline Deferred tax non-current liability & 225,007,000.00 & 20,413,000.00 & 6,379,000.00 \\ \hline Property, land and Property & 115,718,000.00 & 215,883,000.00 & 34,725,000.00 \\ \hline Investment property & 85,070,000.00 & 19,242,000.00 & 1,450,000.00 \\ \hline Intangible assets & 244,000.00 & 287,000.00 & 353,000.00 \\ \hline Other non-current assets & - & 482,000.00 & 502,000.00 \\ \hline Deferred tax non-current asset & 9,420,000.00 & 172,000.00 & 21,000.00 \\ \hline Inventories & 413,165,000.00 & 83,663,000.00 & 18,309,000.00 \\ \hline Prepayments & 205,598,000.00 & 16,054,000.00 & 3,099,000.00 \\ \hline Trade and other receivables & 291,236,000.00 & 56,580,000.00 & 7,257,000.00 \\ \hline Other current financial assets & - & - & 160,000.00 \\ \hline Cash and cash equivalents & 205,677,000.00 & 18,839,000.00 & 10,318,000.00 \\ \hline Share capital & 36,000.00 & 36,000.00 & 36,000.00 \\ \hline Capital in excess of the nominal & 1,380,000.00 & 1,380,000.00 & 1,380,000.00 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|r|} \hline Non distributable reserves & 876,640,000.00 & 199,487,000.00 & 24,019,000.00 \\ \hline Retained earnings & \multicolumn{1}{|c|}{?} & \multicolumn{1}{c}{?} & 2,476,000.00 \\ \hline Trade payables & 215,952,000.00 & 51,986,000.00 & 9,386,000.00 \\ \hline Payroll accruals & 69,320,000.00 & 10,659,000.00 & 1,241,000.00 \\ \hline VAT accruals & 17,136,000.00 & 2,186,000.00 & - \\ \hline Utilities accued & 13,011,000.00 & 3,034,000.00 & - \\ \hline Other payables & 48,914,000.00 & 10,553,000.00 & 3,802,000.00 \\ \hline Contract current liabilities & 15,762,000.00 & 2,054,000.00 & - \\ \hline Short term potion -long term Bank borrowing & 2,773,000.00 & 3,379,000.00 & 965,000.00 \\ \hline Short term potion -Vendor long term borrowing & - & 3,668,000.00 & 168,000.00 \\ \hline Short - term bank loan & 360,534,000.00 & 12,400,000.00 & 1,276,000.00 \\ \hline Bank overdraft & - & 4,477,000.00 & 388,000.00 \\ \hline Dividend payable outstanding & 396,000.00 & 151,000.00 & 88,000.00 \\ \hline Income tax payable outstanding & 43,668,000.00 & 10,657,000.00 & 501,000.00 \\ \hline & 358,000,850.00 & 358,000,850.00 & 358,000,850.00 \\ \hline Number of shares outstanding & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts