Question

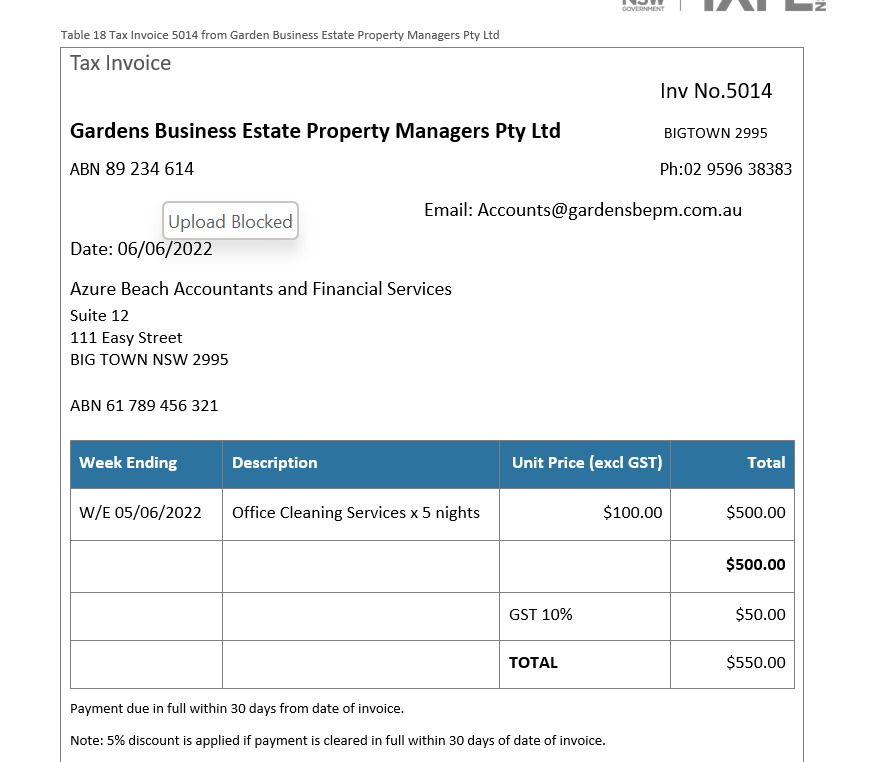

Prepare General Journal entryfor this invoices and and any discount received (The Property Manager offers a discount of 5% for early payment of invoices for

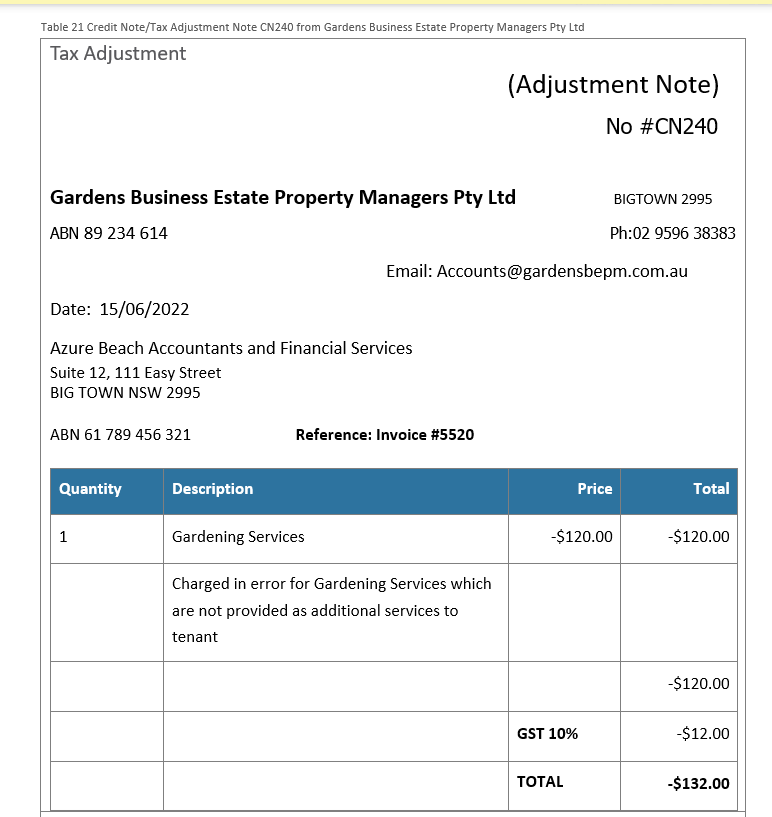

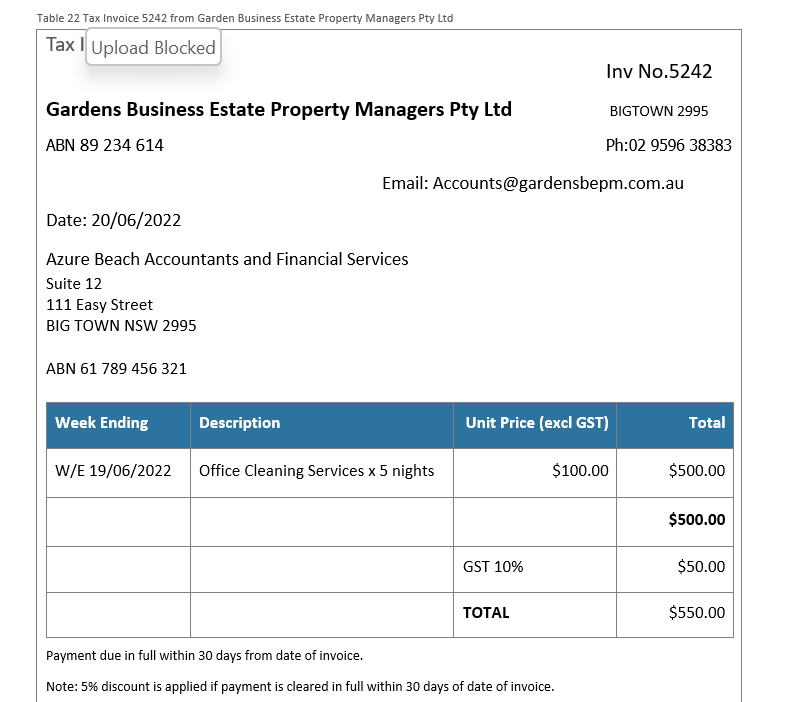

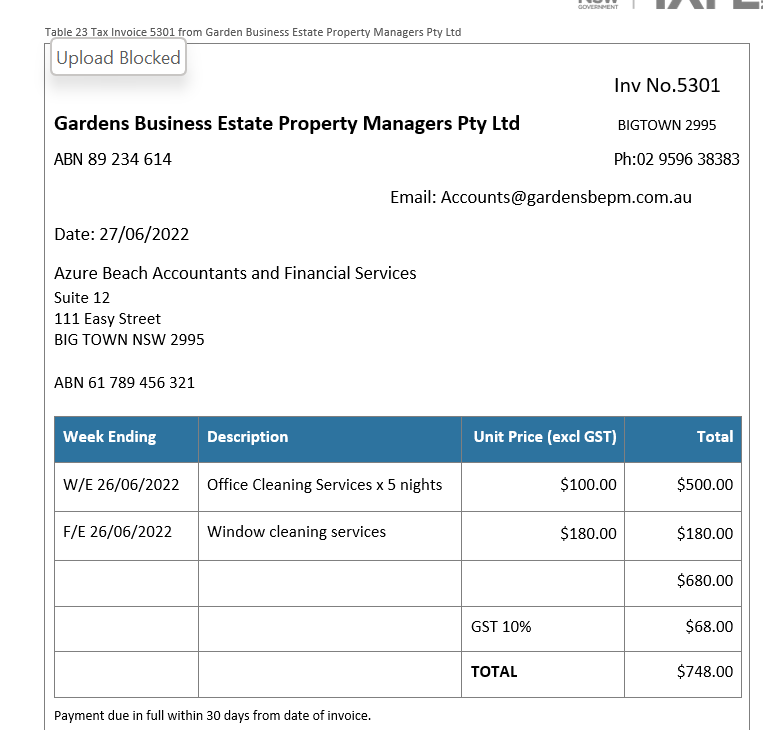

Prepare General Journal entryfor this invoices and and any discount received (The Property Manager offers a discount of 5% for early payment of invoices for the additional services provided if payment is cleared before 30 days of the date of the invoice.) and include the adjustment note

1/ assuming the inv No 5014 payment is made on 28/06/22

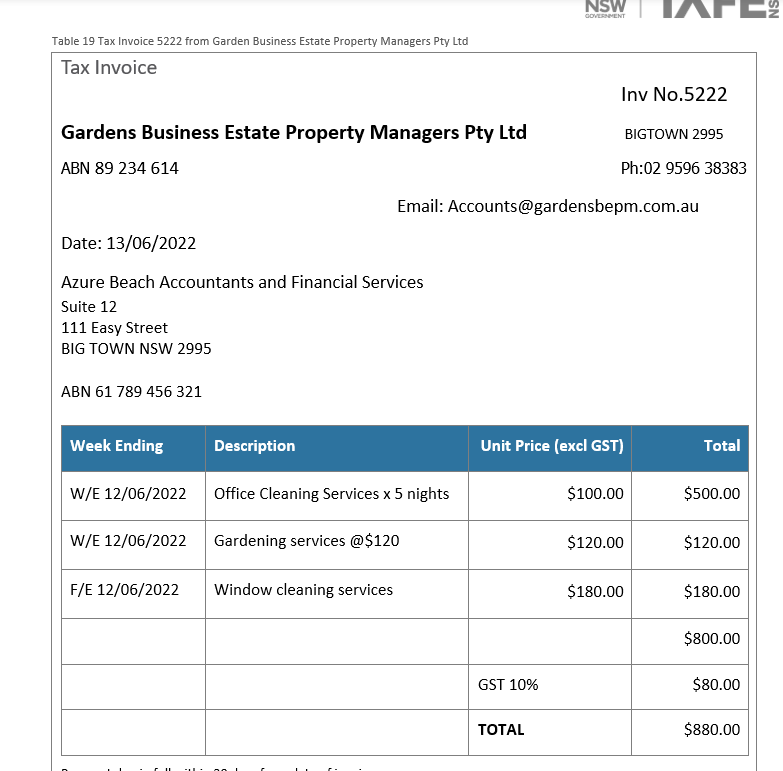

2/ Invoice #5222assuming that payment is made on 29/06/22

3/ Adjustment Note #CN240

4/ Invoice #5242assuming that payment is made next month on 03/07/22

5/ Invoice #5301 assuming that payment is made next month on 10/07/22

Table 18 Tax Invoice 5014 from Garden Business Estate Property Managers Pty Ltd Tax Invoice GOVERNMENT Gardens Business Estate Property Managers Pty Ltd ABN 89 234 614 Upload Blocked Date: 06/06/2022 Inv No.5014 BIGTOWN 2995 Ph:02 9596 38383 Email: Accounts@gardensbepm.com.au Azure Beach Accountants and Financial Services Suite 12 111 Easy Street BIG TOWN NSW 2995 ABN 61 789 456 321 Week Ending Description W/E 05/06/2022 Office Cleaning Services x 5 nights Payment due in full within 30 days from date of invoice. Unit Price (excl GST) Total $100.00 $500.00 $500.00 GST 10% $50.00 TOTAL $550.00 Note: 5% discount is applied if payment is cleared in full within 30 days of date of invoice. N:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started