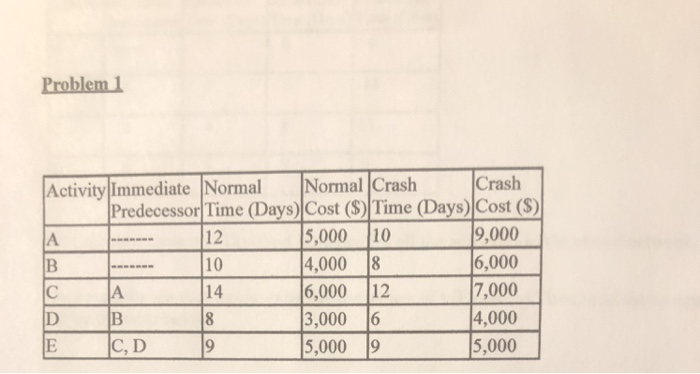

Question: Problem 1 Activity Immediate Normal Normal Crash Crash Predecessor Time (Days) Cost ($) Time (Days) Cost ($) A 12 5,000 110 9,000 B - 10

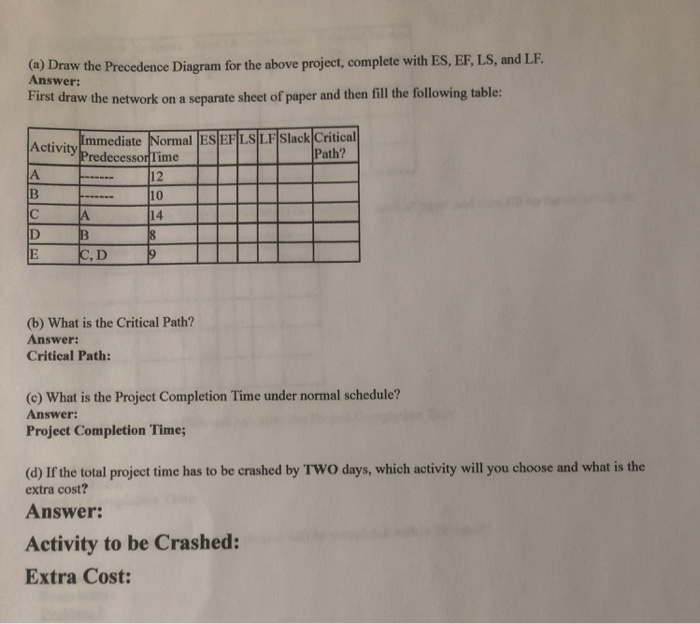

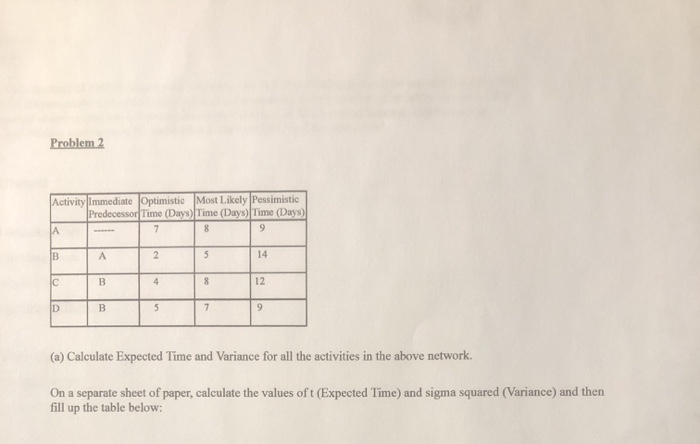

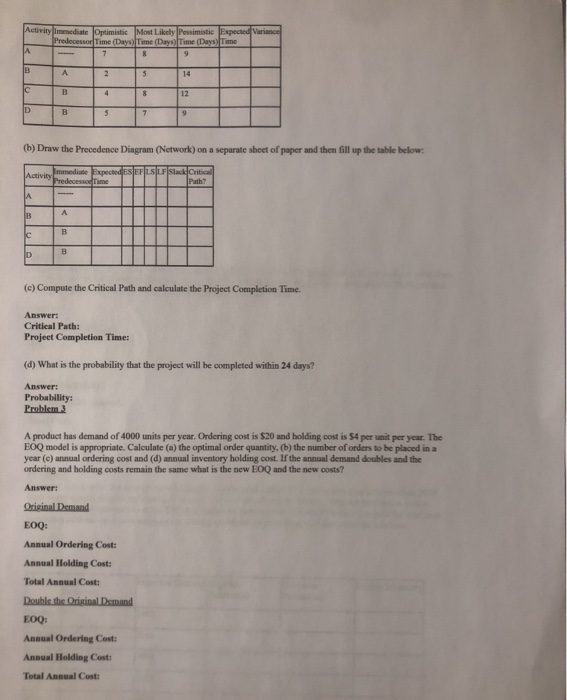

Problem 1 Activity Immediate Normal Normal Crash Crash Predecessor Time (Days) Cost ($) Time (Days) Cost ($) A 12 5,000 110 9,000 B - 10 4,000 18 16,000 16,000 12 17.000 D B 8 3,000 16 4,000 E |C, D 5,000 19 5,000 A 114 (a) Draw the Precedence Diagram for the above project, complete with ES, EF, LS, and LF. Answer: First draw the network on a separate sheet of paper and then fill the following table: Activity Immediate Normal ESJEFLSLF SlackCritical "Predecessor Time Path? -- -- 12 110 (b) What is the Critical Path? Answer: Critical Path: (@) What is the Project Completion Time under normal schedule? Answer: Project Completion Time; (d) If the total project time has to be crashed by TWO days, which activity will you choose and what is the extra cost? Answer: Activity to be Crashed: Extra Cost: Problem 2 Activity Immediate Optimistic Most Likely Pessimistic Predecessor Time (Days) Time (Days) Time (Days) (a) Calculate Expected Time and Variance for all the activities in the above network. On a separate sheet of paper, calculate the values of t (Expected Time) and sigma squared (Variance) and then fill up the table below: Activity mediante Optimistic Most Likely Pessimistic Expected Varer PredeceTime (Deys, The (Das (Days 3 14 (b) Draw the Precedence Diagram (Network) on a separate sheet of paper and then fill up the table below AT (c) Compute the Critical Path and calculate the Project Completion Time. Answer: Critical Path: Project Completion Time: (d) What is the probability that the project will be completed within 24 days? Answer: Probability: Problem 3 A product has demand of 4000 units per year. Ordering cost is $20 and holding cost is 54 per unit per year. The FOQ model is appropriate. Calculate() the optimal order quantity. (b) the number of orders to be placed in a year (c) annual ordering cost and (d) annual inventory holding cost. If the annual demand doubles and the ordering and holding costs remain the same what is the new EOQ and the new costs? Answer: Original Demand EOQ: Annual Ordering Cost: Annual Holding Cost: Total Annual Cost: Double the Original Demand EOQ: Annual Ordering Cost: Annual Holding Cost: Total Annual Cost