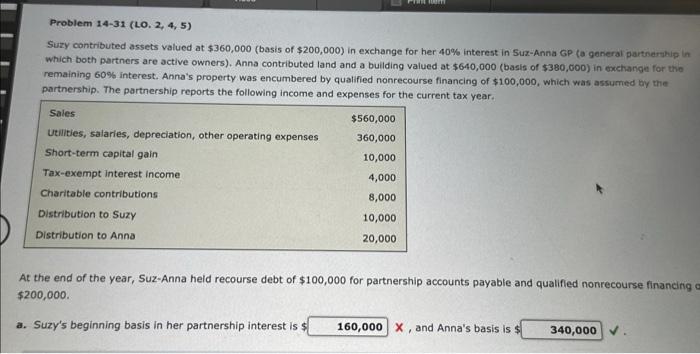

Question: Problem 14-31 (Lo. 2,4,5) Suzy contributed assets valued at $360,000 (basis of $200,000 ) in exchange for her 40% interest in Suz-Anna GP (a general

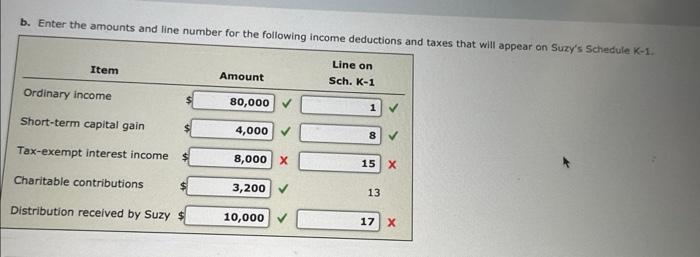

Problem 14-31 (Lo. 2,4,5) Suzy contributed assets valued at $360,000 (basis of $200,000 ) in exchange for her 40% interest in Suz-Anna GP (a general partseruhip in which both partners are active owners). Anna contributed land and a building valued at $640,000 (basis of $380,000 ) in oxchange for the remaining 60% interest. Anna's property was encumbered by qualified nonrecourse financing of $100,000, which was assumed by the partnership. The partnership reports the following income and expenses for the current tax year. At the end of the year, Suz-Anna held recourse debt of $100,000 for partnership accounts payable and qualifled nonrecourse financing $200,000. a. Suzy's beginning basis in her partnership interest is $ X, and Anna's basis is taxes that will appear on Suzy's Schedule k1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts