Question: Q. 3 (10 points) Consider a call option and a put option that have the same underlying stock (which does not pay out any dividend

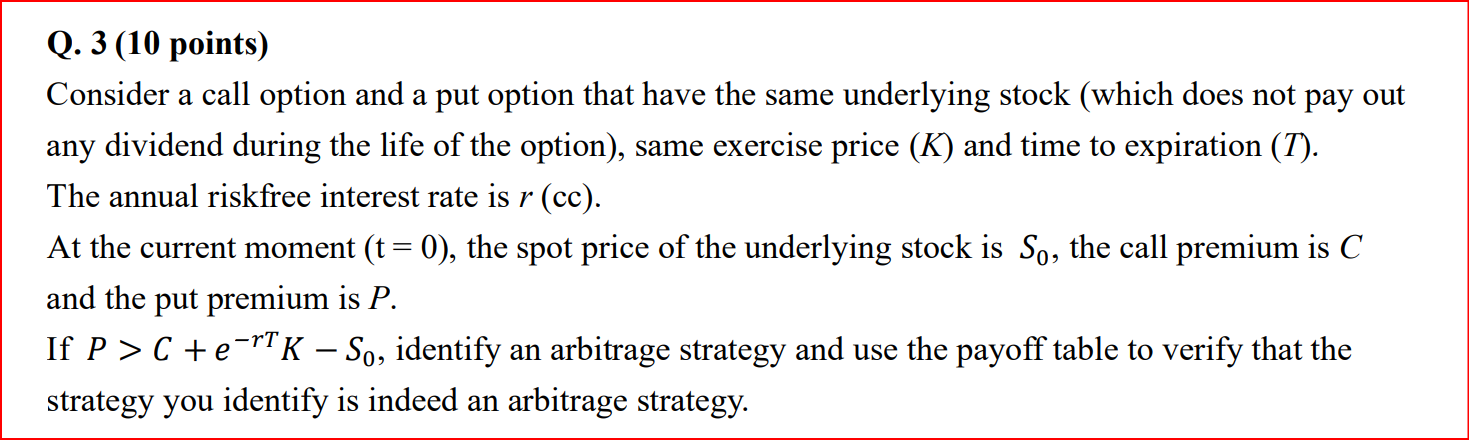

Q. 3 (10 points) Consider a call option and a put option that have the same underlying stock (which does not pay out any dividend during the life of the option), same exercise price (K) and time to expiration (T). The annual riskfree interest rate is r(cc). At the current moment (t=0), the spot price of the underlying stock is S0, the call premium is C and the put premium is P. If P>C+erTKS0, identify an arbitrage strategy and use the payoff table to verify that the strategy you identify is indeed an arbitrage strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts