Question: Problem 3 (Required, 25 marks) We consider a market with 1 riskfree asset and N risky assets. The following tables show the investment goal of

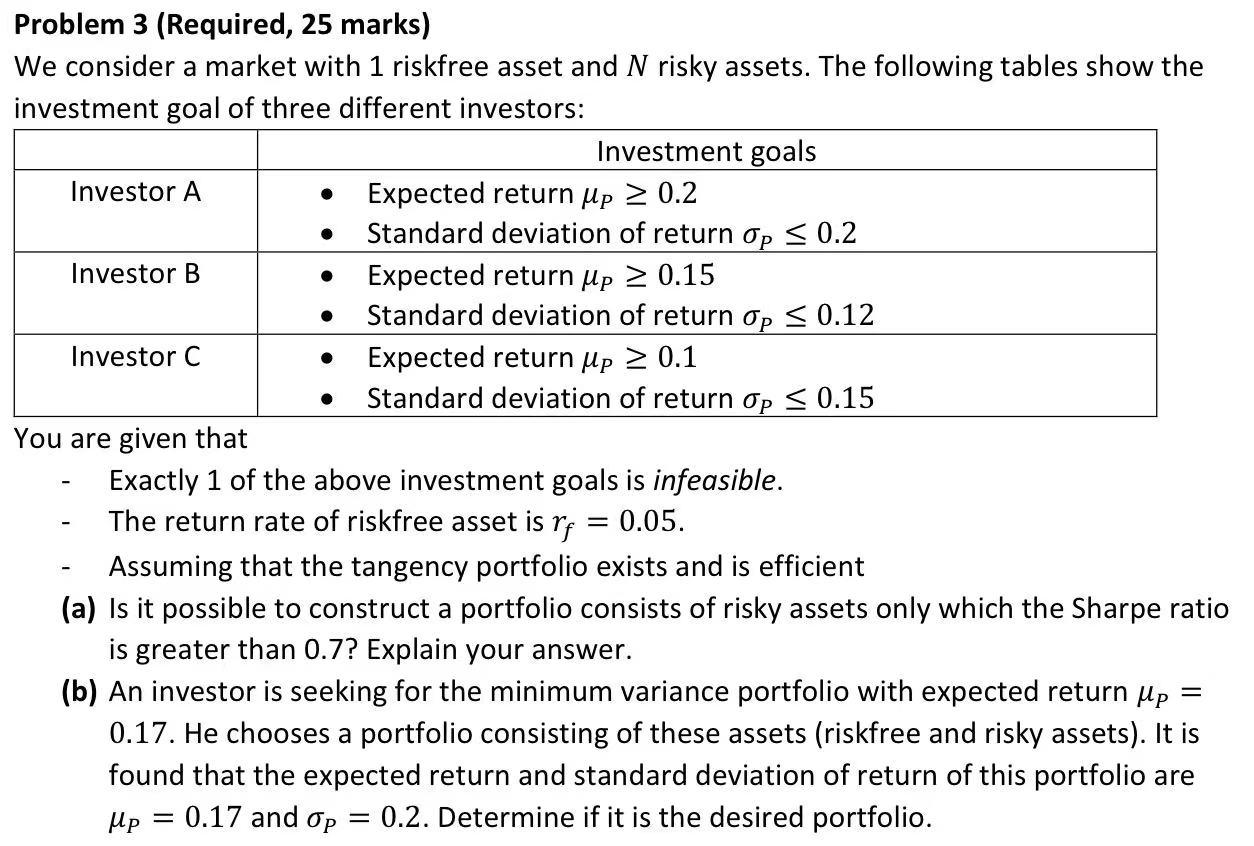

Problem 3 (Required, 25 marks) We consider a market with 1 riskfree asset and N risky assets. The following tables show the investment goal of three different investors: You are given that - Exactly 1 of the above investment goals is infeasible. - The return rate of riskfree asset is rf=0.05. - Assuming that the tangency portfolio exists and is efficient (a) Is it possible to construct a portfolio consists of risky assets only which the Sharpe ratio is greater than 0.7? Explain your answer. (b) An investor is seeking for the minimum variance portfolio with expected return P= 0.17 . He chooses a portfolio consisting of these assets (riskfree and risky assets). It is found that the expected return and standard deviation of return of this portfolio are P=0.17 and P=0.2. Determine if it is the desired portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts