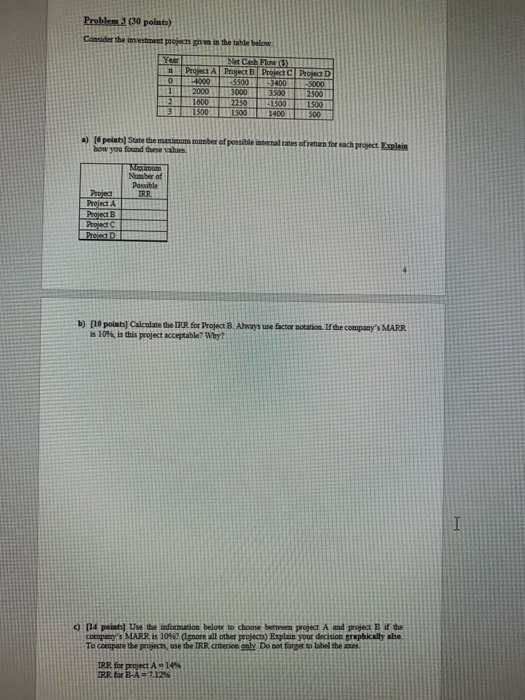

Question: Problem (30 points) Consider the investment projects given in the table below 0 1 2 13 Nece Flow (1) Projet A Project Project Project -4000

Problem (30 points) Consider the investment projects given in the table below 0 1 2 13 Nece Flow (1) Projet A Project Project Project -4000 5500 1:3400 -5000 2000 3000 3500 2500 1600 22:50 -1500 1500 1500 1500 1400 500 A) (6 points State the mecimum manber of possibile internal rates of return for each project. Explain how you found these values Mein Number of Possible Project IRR Prajed A Project Project Project D b) [10 points Calculate the IRR for Project B Always use factor notation. If the company's MARR is 10%, in this project acceptable? Why? I o 14 points Use the information below to choose between project A and project B if the company': MARR is 10% (gore all other projects) Esplain your decision graphically be To compare the projects, use the IRR criterio only Do not forget to label the aces. IRR for project A-14% TRR for B-A=7.1296

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts