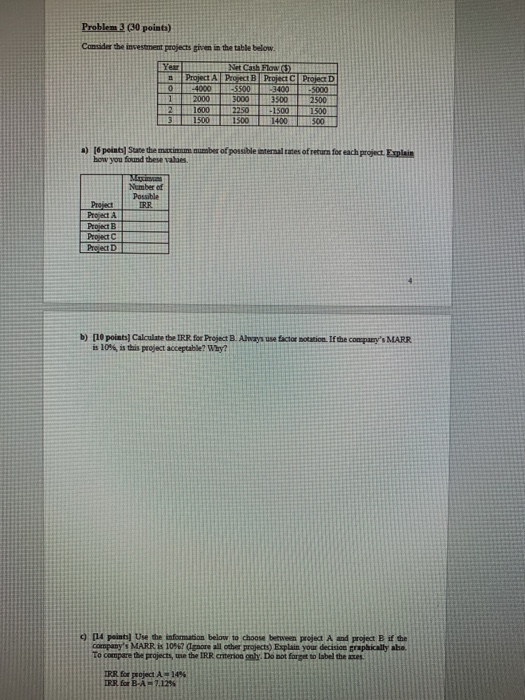

Question: Problem 3 (30 points) Consider the investment projects given in the table below Year 0 1 2 3 Net Cash Flow (5) Project A Proect

Problem 3 (30 points) Consider the investment projects given in the table below Year 0 1 2 3 Net Cash Flow (5) Project A Proect Project Project D -4000 -5500 3400 -5000 2000 3000 3300 2500 1600 2250 -1500 1500 1500 1500 1400 500 a) [6 points Suate the main number of possible internal rates of return for each project. Explain how you found these values MO Number of Possible IRR Project Project A Project B Project C Project D b) [10 points Calculate the IRR for Project B. Always use factor notation. If the company's MARR is 10%, is this project acceptable? Why? 2014 points Use the information below to choose between project A and project if the company's MARR is 1097 Lenore all other projects) Explain your decision graphically ahe. To compare the projects, use the IRR criterios ly. Do not forget to label the stes IRR for projed A-10% IRR for B-A 7.12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts