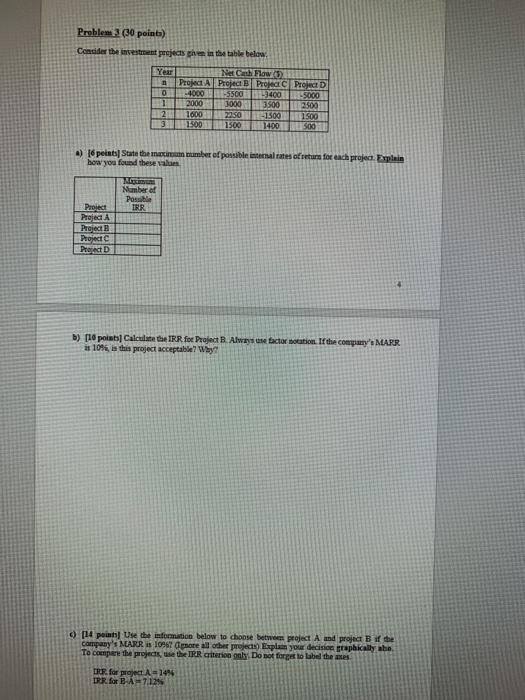

Question: Problem 3 (30 points) Consider the investment projects given in the table below 0 1 2 3 Ne Cash Flow (5 Project A Project Project

Problem 3 (30 points) Consider the investment projects given in the table below 0 1 2 3 Ne Cash Flow (5 Project A Project Project Project D -4000 5500 3400 5000 2000 3500 2500 1600 2250 -1500 1500 1300 1500 1400 500 3000 a) [6 peints State the maximum manber of possible internal rates of return for each project. Explain how you found these valors Number of Possible IRR Project Project A Project B Project Project D b) [10 points Calculate the IRR for Project B. Always use factor notation. If the company's MARR is 10%, is this project acceptable? Why? 0 14 points Use the information below to choose between project A and project B if the company's MARR is 10967 note all other project) Esplan your decision graphically abe To compare the projects, use the IRR criterion only. Do not forget to label the es IRE. for project A -14% IRR for B-A 7.12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts