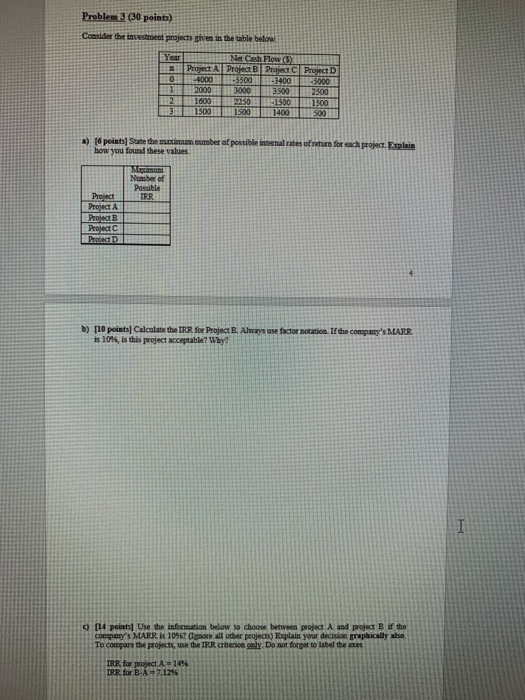

Question: Problem 3 (30 points) Consider the investment projects given in the table below. Year 0 1 NetCash Flow 5) Project A Project Project Project 4000

Problem 3 (30 points) Consider the investment projects given in the table below. Year 0 1 NetCash Flow 5) Project A Project Project Project 4000 -5500 -3400 -5000 2000 3000 3500 2500 1600 2250 -1500 1500 1500 1500 1400 500 2 3 a) 16 points State the main sumber of possible internal rates of return for each project, Explais how you found these values Momom Nuber of Possible IRR Protect Project A Project B Project C Project D b) [10 points Calculate the IRR for Project B. Always use factor notation. If the company's MARR is 10%, is this project acceptable? Why? I [14 points. Use the information below to choose between project A and project if the company's MARR is 1096 sore all other projects) Esplain your decision graphically aho To compare the projects, use the IRR criterio cely. Do not forget to label the IRR. for project A = 14% IRR for B-A=7.1296

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts