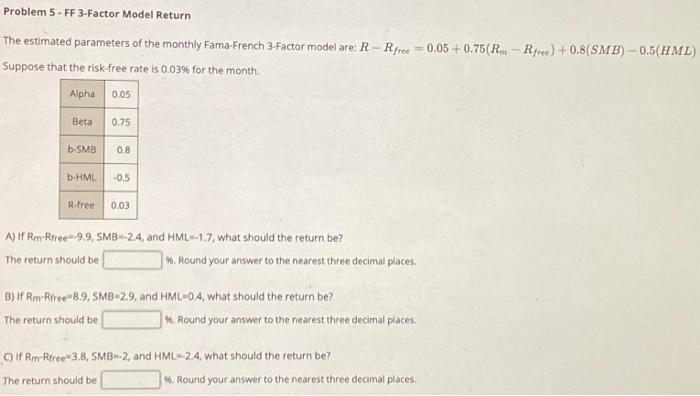

Question: Problem 5- FF 3-Factor Model Return The estimated parameters of the monthly Fama-French 3-Factor model are: R- Suppose that the risk-free rate is 0.03% for

Problem 5 - FF 3-Factor Model Return The estimated parameters of the monthly Fama-French 3 -Factor model are: RRfree=0.05+0.75(R an R free )+0.8(SMB)0.5(HML) Suppose that the risk-free rate is 0.03% for the month. A) If RmRffee19.9,5MB24, and HML=-1.7, what should the return be? The return should be 06. Round your answer to the nearest three decimal places. B) If RmR free =8.9,5MB=29, and HML=0.4, what should the return be? The return should be 4. Round your answer to the nearest three decimal places. C) if RmRfree=3.8,5MB=2, and HML=2.4, what should the return be? The return should be 4. Round your answer to the nearest three decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts