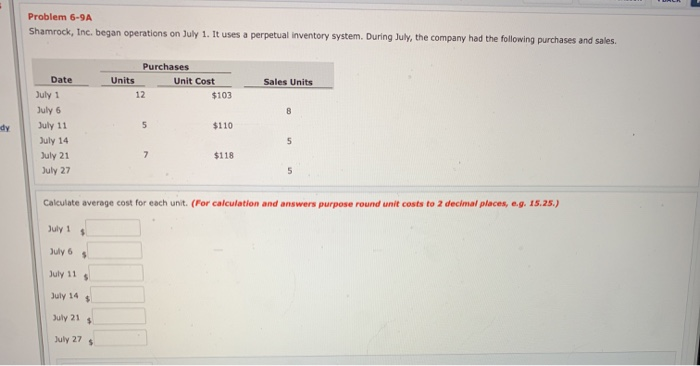

Question: Problem 6-9A Shamrock, Inc. began operations on July 1. It uses a perpetual inventory system. During July, the company had the following purchases and sales.

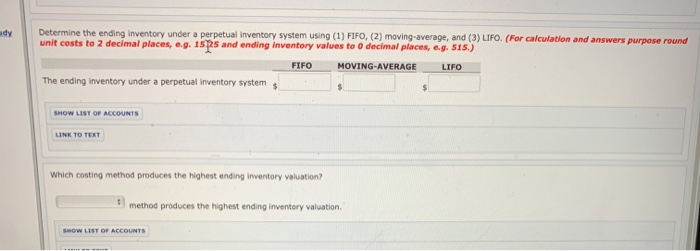

Problem 6-9A Shamrock, Inc. began operations on July 1. It uses a perpetual inventory system. During July, the company had the following purchases and sales. Purchases Units Unit Cost 12 $103 Sales Units B dy Date July 1 July 6 July 11 July 14 July 21 July 27 5 $110 5 7 $118 5 Calculate average cost for each unit. (For calculation and answers purpose round unit costs to 2 decimal places, e.g. 15.25.) July 1 $ July July 11 $ July 14 $ July 21 s July 27 $ dy Determine the ending Inventory under a perpetual Inventory system using (1) FIFO, (2) moving-average, and (3) LIFO. (For calculation and answers purpose round unit costs to 2 decimal places, e.g. 15ps and ending inventory values to o decimal places, e.g. 515.) FIFO MOVING-AVERAGE LIFO The ending inventory under a perpetual inventory system SHOW LIST OF ACCOUNTS LINK TO TEXT Which costing method produces the highest ending inventory valuation? method produces the highest ending inventory valuation SHOW LIST OF ACCOUNTS SHOW LIST OF ACCOUNTS LINK TO TEXT Which costing method produces the highest ending inventory vale method produces the highest ending inventory Average-cost FIFO LIFO DUNTS LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts