Question: Problem 7-26 Uncle Fred recently died and left $360,000 to his 45-year-old favorite niece. She immediately spent $110,000 on a town home but decided to

Problem 7-26

Uncle Fred recently died and left $360,000 to his 45-year-old favorite niece. She immediately spent $110,000 on a town home but decided to invest the balance for her retirement at age 65. What rate of return must she earn on her investment over the next 20 years to permit her to withdraw $85,000 at the end of each year through age 85 if her funds earn 9 percent annually during retirement? Use Appendix A and Appendix D to answer the question. Round your answer to the nearest whole number. %

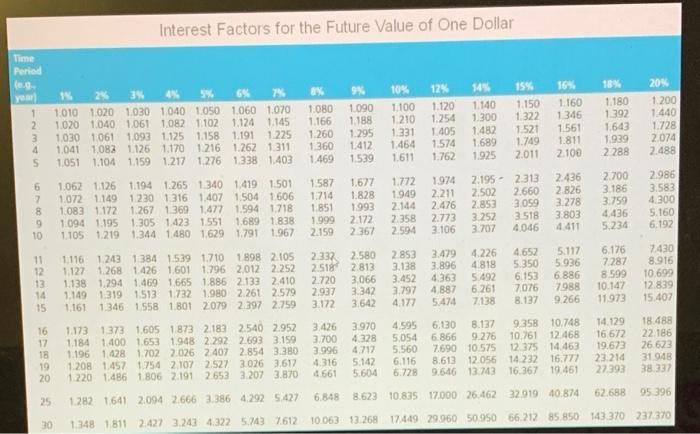

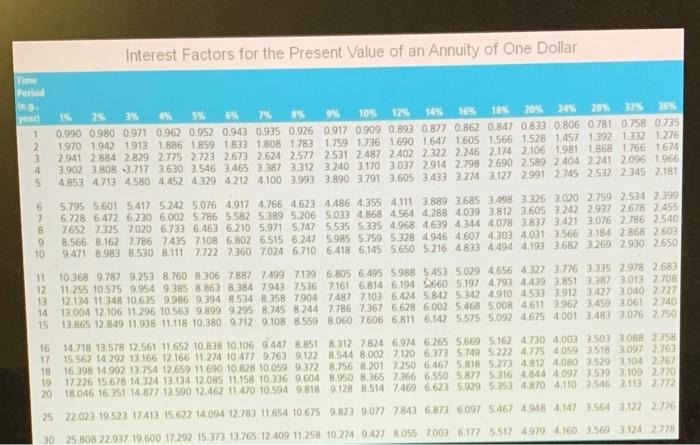

Interest Factors for the Future Value of One Dollar Time Period 1 2 3 4 5 1 3% 5% 7% 1010 1020 1030 1040 1050 1.060 1070 1.020 1.040 1061 1082 1.102 1.124 1.145 1.030 1061 1,093 1.125 1.158 1.191 1.225 1.041 1.082 1126 1.170 1.216 1.262 1.311 1051 1.104 1159 1.217 1.276 1.338 1.403 1.080 1.166 1.260 1360 1.469 9% 1.090 1.188 1.295 1.412 1.539 10% 1.100 1.210 1331 1.464 1.611 12% 1.120 1.254 1.405 1.574 1.762 14 1.140 1.300 1.482 1.689 1.925 15% 1.150 1.322 1521 1.749 2.011 16% 1.160 1 346 1.561 1.811 2.100 18% 1.180 1.392 1.643 1.939 2.288 20% 1.200 1.440 1.728 2.074 2.488 6 7 8 9 10 1.062 1126 1.194 1.265 1340 1.419 1.501 1.072 1149 1230 1.316 1.407 1504 1606 1.083 1.1721.267 1369 1677 1.594 1718 1.094 1.195 1.305 1.423 1551 1.689 1838 1105 1219 1.344 1480 1629 1791 1.967 1587 1.714 1851 1.999 2.159 1.677 1.828 1993 2.172 2 367 1.772 1949 2.144 2.358 2.594 1974 2.211 2.476 2.773 3.106 2.195 - 2313 2.502 2.660 2.853 3.059 3.252 3.518 3.707 4.046 2.436 2.826 3.278 3.803 4411 2.700 3.186 3.759 4.436 5.234 2986 3.583 4.300 5.160 6.192 11 12 13 14 15 1116 1243 1384 1.539 1710 1898 2.105 1.127 1268 1426 1.601 1.796 2012 2.252 1.138 1.294 1469 1665 1.886 2.133 2410 1.149.319 15131732 1.980 2.261 2579 1.161 1.346 1558 1801 2079 2.3972.759 2337 2.518 2.720 2.937 3.172 2.580 2.813 3,066 3.342 3.642 2.853 3.138 3.452 3.797 4.177 3.479 3.896 4.363 4.887 5:474 4.226 4.818 5.492 6.261 7138 4.652 5.350 6.153 7076 8.137 5.117 5.936 6 886 7988 9.266 6.176 7.287 8.599 10.147 11973 7430 8.916 10.699 12839 15.407 16 17 18 19 20 1.173 1373 1.605 1873 2.183 2540 2.952 1.184 1400 1653 1948 2.292 2.693 3.159 1.196 1.428 1.702 2.026 2407 2854 3.380 1.208 1.4571754 2 107 2.527 3.026 3.617 1 220 1.486 1.806 2.191 2.653 3 207 3.870 3.426 3.700 3.996 4.316 4661 3.970 4.328 4,212 5.142 5.604 4.595 5.054 5.560 6.116 6.728 6.130 8.137 9.358 10.748 6.866 9.276 10.761 12.468 7.690 10.575 12.375 14.463 8.613 12.056 14.232 16.777 9.646 13743 16.367 19.451 14.129 16,672 19.673 23.214 27393 18.488 22 186 26.623 31 948 38.337 25 62.688 95 396 6.848 1282 641 2.094 2.666 3.386 4.2925.427 8.623 10.835 12.000 26.4623291940.874 30 1348 1811 2.427 3.243 4.3225.743 7612 10.063 13.268 17.449 29.960 50.950 66.212 85.850 143.370 237370 Interest Factors for the Present Value of an Annuity of One Dollar Time Putled 2 3 4 5 3% 5% 89 9% 10% 12% 144 16% 189 205 24% 28 32 33 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0917 0.909 0.893 0.877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1970 1942 1913 1886 1859 1833 1808 1783 1759 1736 1690 1647 16051566 1.528 1.457 1392 1332 1.276 2.941 2884 2829 2775 2.723 2673 2.624 2.577 2531 2487 2.402 2322 2246 2174 2106 1981 1.868 1.766 1674 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.037 2914 2.798 2690 2.589 2.404 2.241 2.096 1.966 4.853 4713 4580 4.452 4329 4.212 4.100 3.993 3.890 3.791 3.605 3.433 3.274 2.127 2991 2.749 2532 2.345 2.181 6 7 8 9 10 5.795 5.601 5.417 5.2425.076 4917 4.766 4.623 4.486 4355 4.111 3.889 3.685 3.498 3326 3.020 2.759 2.534 2399 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5033 4.868 4564 4.288 4.039 3.812 3.605 3.242 2.937 2678 2455 76527325 7020 6.733 6.463 6.210 5.971 5.747 5.535 5335 4968 4639 4344 4.078 3837 3.421 3.076 2786 2540 8.566 8.162 7.786 7.435 7108 6.B02 6.515 6 247 5985 5.759 5.328 49464.607 4303 4.031 3.566 3.184 2.868 03 9.471 8983 8.530 8.111 7722 7360 7.024 6.710 6.418 6.145 5.650 5.216 4833 4.494 4.193 3.682 3.269 2.930 2650 11 12 13 14 15 10.368 9.787 9.253 8.760 8.306 78877.499 7139 6.805 6.495 5988 5.453 5029 4.656 432737763335 2.978 2683 11.255 10.575 9.954 9.385 8.563 B 384 7943 753621616.814 6.194 386605.197 47934439 3.851 3387 3.013 2.708 12.134 11.348 10.635 99869.394 8.534 8.358 7904 7.487 7103 6.424 5 842 5.342 4910 4533 3912 3.427 3.040 2727 13.004 12 106 11.296 10.563 9899 9.295 8.745 8.244 7.786 7367 6.628 6.002 5.468 5008 4,611 3.962 3.459 1.061 2.740 13.865 12.849 11.938 11.118 10 3809712 9.108 8.559 80607606 6.811 6.142 5.575 5.092 4.675 4.001 3.483 3,076 2.750 16 17 18 19 20 14,718 13.578 12.561 11652 10.838 10.106 9.447 8,851 8.312 7824 6.974 6.265 5.669 5.162 4.7304003 2.503 3088 2758 15.562 14.292 13.166 12.166 11 274 10.477 9.763 9.122 8.544 8.00271206.373 5.749 5.222 4.775 4,059 3518 3097 2.763 16.398 14.992 13.754 12 659 11690 10.828 10.059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4.812 4.08035292.104 2767 17.226 15.678 14.324 13.134 12085 11.158 10.336 9.604 8.950 8.365 7366 6.550 5.877 5.316 484440973.539 3.109 2.770 18.046 16 351 14.877 13 590 12.462 11.470 10 594 9818 9.128 8.514 7.469 6.623 5.92954253 4870 4.110 3.5463.113 2.772 25 22.023 19.523 17413 15.622 14.094 12.783 11.654 10.675 9.8239.07778436.873 6097 5.467 448 4.147 3.5643122 2.776 3025 808 22.937 19 600 17.292 15 373 13.765 12.409 11.258 10.274 9.427 8055 7003 5.1725.517 4.9794160150031242778

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts