Question: Problem Set 2 - Discounted Cash Flow Valuation and Net Present Value 1. You are offered three annuities for purchase. Annuities make payments over a

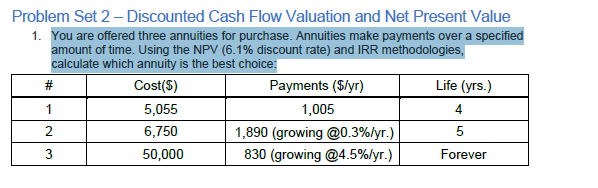

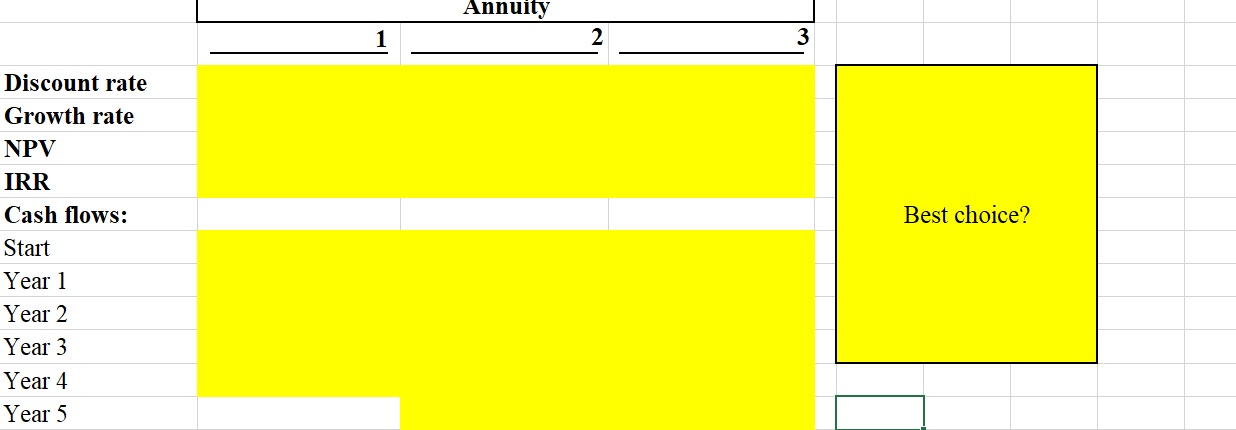

Problem Set 2 - Discounted Cash Flow Valuation and Net Present Value 1. You are offered three annuities for purchase. Annuities make payments over a specified amount of time. Using the NPV (6.1% discount rate) and IRR methodologies, calculate which annuity is the best choice: # Cost($) Payments ($/yr) Life (yrs.) 1 5,055 1,005 2 6,750 1,890 (growing @0.3%/yr.) 5 3 50,000 830 (growing @4.5%/yr.) Forever 4 2 Annuity 2 Best choice? Discount rate Growth rate NPV IRR Cash flows: Start Year 1 Year 2 Year 3 Year 4 Year 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts