Question: PROBLEM V: PREPARING THE PAYROLL TAX ENTRY (10 P TAX ENTRY (10 POINTS) Using the information below, determine the amount of the payroll as payroll

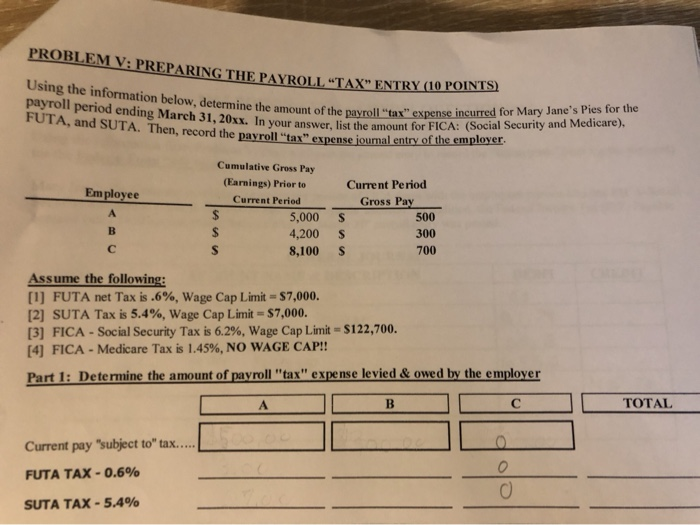

PROBLEM V: PREPARING THE PAYROLL "TAX" ENTRY (10 P TAX" ENTRY (10 POINTS) Using the information below, determine the amount of the payroll as payroll period ending March 31, 20xx. In your answer. list the amount for FUTA, and SUTA. Then, record the payroll "tax" expense joumal entry o he payroll "tax" expense incurred for Mary Jane's Pies for the ord the payroll "tax" expense joumal entry of the employer. wer, list the amount for FICA: (Social Security and Medicare), 500 Cumulative Gross Pay (Earnings) Prior to Current Period Employee Current Period Gross Pay 5,000 $ 4,200 $ 300 8,100 $ 700 Assume the following: [1] FUTA net Tax is .6%, Wage Cap Limit = $7,000. [2] SUTA Tax is 5.4%, Wage Cap Limit = $7,000. [3] FICA - Social Security Tax is 6.2%, Wage Cap Limit - $122,700. [4] FICA - Medicare Tax is 1.45%, NO WAGE CAP!! Part 1: Determine the amount of payroll "tax" expense levied & owed by the employer - BCC C TOTAL Current pay "subject to tax.... FUTA TAX - 0.6% SUTA TAX - 5.4% clop PROBLEM V: PREPARING THE PAYROLL "TAX" ENTRY (10 P TAX" ENTRY (10 POINTS) Using the information below, determine the amount of the payroll as payroll period ending March 31, 20xx. In your answer. list the amount for FUTA, and SUTA. Then, record the payroll "tax" expense joumal entry o he payroll "tax" expense incurred for Mary Jane's Pies for the ord the payroll "tax" expense joumal entry of the employer. wer, list the amount for FICA: (Social Security and Medicare), 500 Cumulative Gross Pay (Earnings) Prior to Current Period Employee Current Period Gross Pay 5,000 $ 4,200 $ 300 8,100 $ 700 Assume the following: [1] FUTA net Tax is .6%, Wage Cap Limit = $7,000. [2] SUTA Tax is 5.4%, Wage Cap Limit = $7,000. [3] FICA - Social Security Tax is 6.2%, Wage Cap Limit - $122,700. [4] FICA - Medicare Tax is 1.45%, NO WAGE CAP!! Part 1: Determine the amount of payroll "tax" expense levied & owed by the employer - BCC C TOTAL Current pay "subject to tax.... FUTA TAX - 0.6% SUTA TAX - 5.4% clop

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts