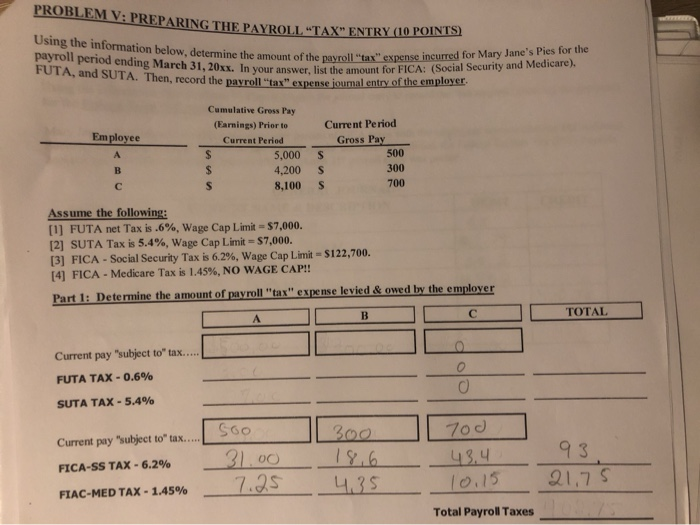

Question: PROBLEM V: PREPARING THE PAYROLL TAX ENTRY (10 Using the information below, determine the amount of the payroll period ending March 31, 20xx. In your

PROBLEM V: PREPARING THE PAYROLL TAX ENTRY (10 Using the information below, determine the amount of the payroll period ending March 31, 20xx. In your answer, list the amount for FICA: SO FUTA, and SUTA. Then, record the payroll "tax" expense journal entry of the em mine the amount of the payroll "tax" expense incurred for Mary Jane's Pies for the T, list the amount for FICA: (Social Security and Medicare), Employee Cumulative Gross Pay (Earnings) Prior to Current Period 5,000 4,200 8,100 Current Period Gross Pay 500 S 300 S 700 Assume the following: [1] FUTA net Tax is .6%, Wage Cap Limit - $7,000. [2] SUTA Tax is 5.4%, Wage Cap Limit - $7,000. [3] FICA - Social Security Tax is 6.2%, Wage Cap Limit = $122,700. [4] FICA - Medicare Tax is 1.45%, NO WAGE CAP!! Part 1: Determine the amount of payroll "tax" expense levied & owed by the employer D DBDCD TOTAL Current pay "subject to tax... FUTA TAX-0.6% SUTA TAX - 5.4% Current pay "subject to tax.....LSSO FICA-SS TAX - 6.2% 31.00 FIAC-MED TAX - 1.45% 7.25 | 300 18.6 435 I7Od 43,4 10.15 21. 75 Total Payroll Taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts