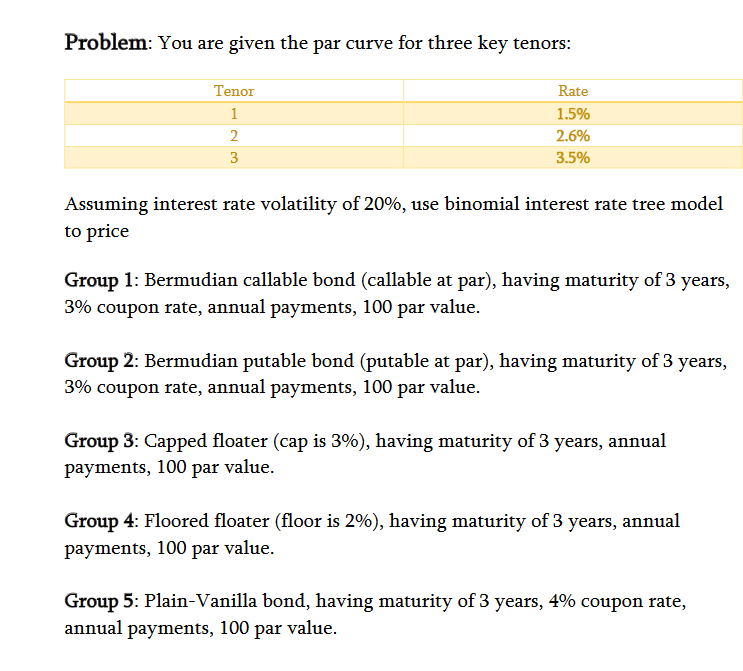

Question: Problem: You are given the par curve for three key tenors: Assuming interest rate volatility of 20%, use binomial interest rate tree model to price

Problem: You are given the par curve for three key tenors: Assuming interest rate volatility of 20%, use binomial interest rate tree model to price Group 1: Bermudian callable bond (callable at par), having maturity of 3 years, 3% coupon rate, annual payments, 100 par value. Group 2: Bermudian putable bond (putable at par), having maturity of 3 years, 3% coupon rate, annual payments, 100 par value. Group 3: Capped floater (cap is 3\%), having maturity of 3 years, annual payments, 100 par value. Group 4: Floored floater (floor is 2% ), having maturity of 3 years, annual payments, 100 par value. Group 5: Plain-Vanilla bond, having maturity of 3 years, 4% coupon rate, annual payments, 100 par value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts