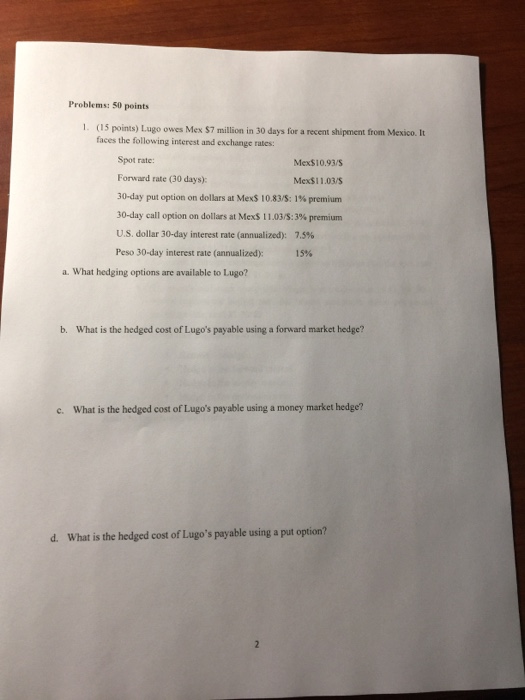

Question: Problems: 50 points 1. (15 points) Lugo owes Mex $7 million in 30 days for a recent shipment from Mexico. It faces the following interest

Problems: 50 points 1. (15 points) Lugo owes Mex $7 million in 30 days for a recent shipment from Mexico. It faces the following interest and exchange rates: Spot ratc: Forward rate (30 days): 30-day put option on dollars al MexS 10.835:1% premium 30-day call option on dollars at Mex$ 11.035: 3% premium U.S. dollar 30-day interest rate (annualized): 7.5% Peso 30-day interest rate (annualized): 15% Mex$10.93/5 Mex$11.03/5 a. What hedging options are available to Lugo? b. What is the hedged cost of Lugo's payable using a forward market hedge? What is the hedged cost of Lugo's payable using a money market hedge? c. d. What is the hedged cost of Lugo's payable using a put option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts