Question: Profitability Ratios (in %) Return on equity Return on assets Profit margin Turnover-Control Ratios Asset turnover Inventory turnover Payables period Leverage and Liquidity Ratios Assets

Profitability Ratios (in %) Return on equity Return on assets Profit margin Turnover-Control Ratios Asset turnover Inventory turnover Payables period Leverage and Liquidity Ratios Assets to equity

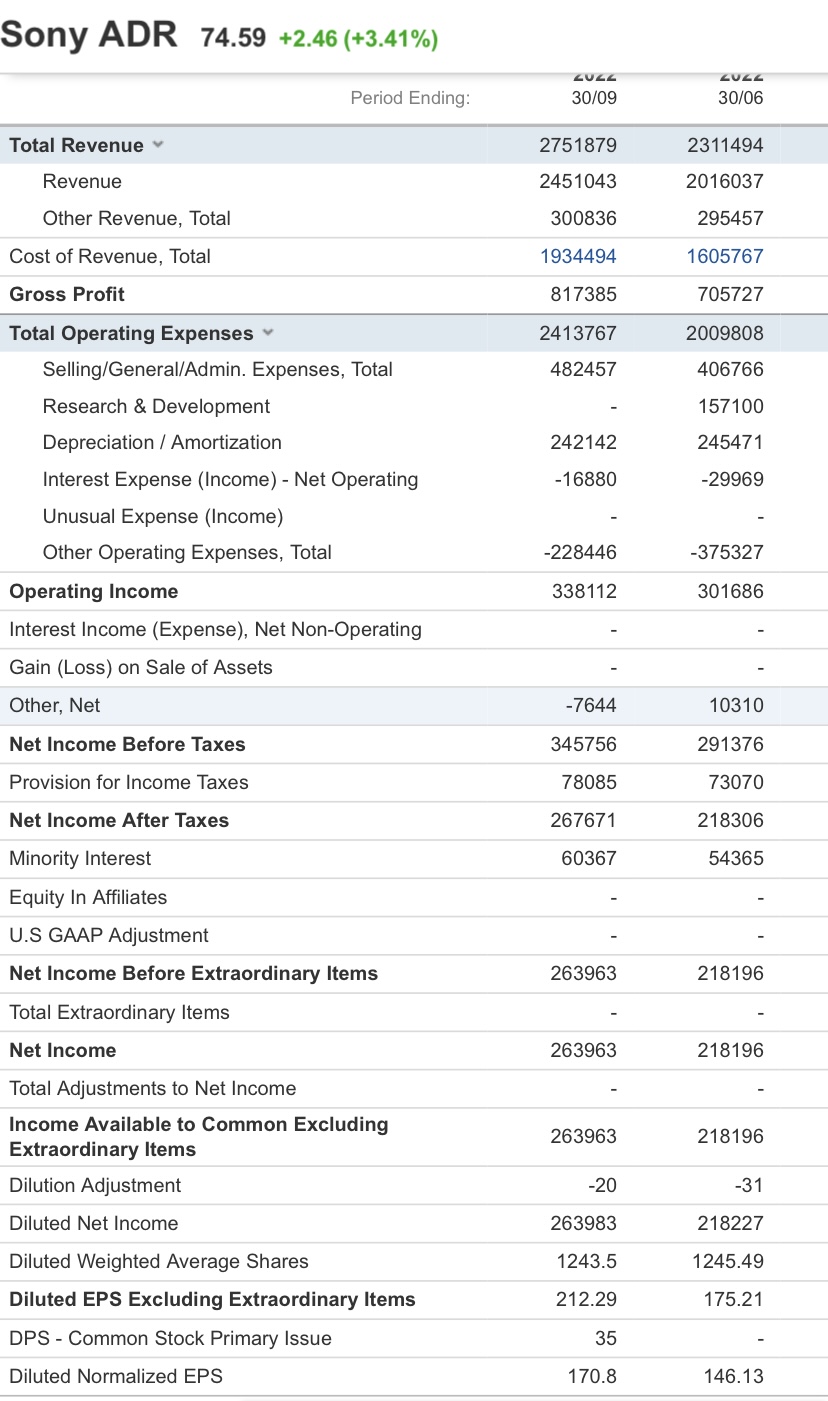

Sony ADR 74.59 +2.46 (+3.41%) U LUL' Period Ending: 30709 30706 Total Revenue V 2751879 2311494 Revenue 2451043 201603? Other Revenue, Total 300836 29545? Cost of Revenue, Total 1934494 1605767 Gross Prot 817385 70572? Total Operating Expenses 9 241376? 2009808 SellinngeneralfAdmin. Expenses, Total 48245? 406766 Research 8 Development - 157100 Depreciation f Amortization 242142 245471 Interest Expense (Income) - Net Operating -1 6880 -29969 Unusual Expense (Income) - - Other Operating Expenses, Total -228446 -37532? Operating Income 338112 301686 Interest Income (Expense), Net Non-Operating - - Gain (Loss) on Sale of Assets - - Other, Net -7644 10310 Net Income Before Taxes 345756 291376 Provision for Income Taxes 78085 73070 Net Income After Taxes 267671 218306 Minority Interest 6036? 54365 Equity In Affiliates - - US GAAP Adjustment - - Net Income Before Extraordinary Items 263963 218196 Total Extraordinary Items - - Net Income 263963 218196 Total Adjustments to Net Income - - Income Available to Common Excluding Extraordinary Items 263953 218196 Dilution Adjustment -20 -31 Diluted Net Income 263983 21822? Diluted Weighted Average Shares 1243.5 1245.49 Diluted EPS Excluding Extraordinary Items 212.29 175.21 DPS - Common Stock Primary Issue 35 - Diluted Normalized EPS 170.8 146.13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts