Question: Q. 4 (Black-Scholes calculations, 30 pts). Consider a stock whose price in t > 0 years from today is St. The price process (St)t>o has

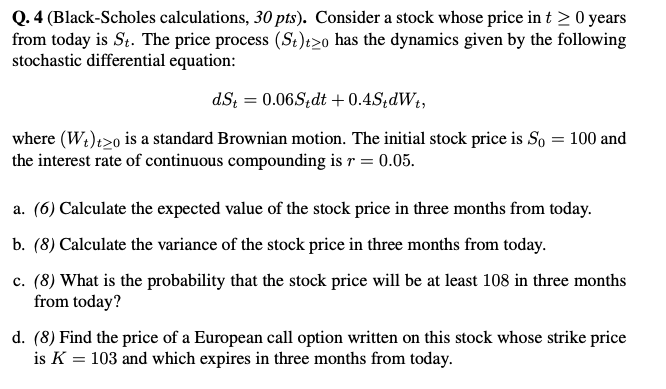

Q. 4 (Black-Scholes calculations, 30 pts). Consider a stock whose price in t > 0 years from today is St. The price process (St)t>o has the dynamics given by the following stochastic differential equation: dSt = 0.06Stdt +0.454dWt, where (Wt)t>o is a standard Brownian motion. The initial stock price is So = 100 and the interest rate of continuous compounding is r = 0.05. a. (6) Calculate the expected value of the stock price in three months from today. b. (8) Calculate the variance of the stock price in three months from today. c. (8) What is the probability that the stock price will be at least 108 in three months from today? d. (8) Find the price of a European call option written on this stock whose strike price is K = 103 and which expires in three months from today. Q. 4 (Black-Scholes calculations, 30 pts). Consider a stock whose price in t > 0 years from today is St. The price process (St)t>o has the dynamics given by the following stochastic differential equation: dSt = 0.06Stdt +0.454dWt, where (Wt)t>o is a standard Brownian motion. The initial stock price is So = 100 and the interest rate of continuous compounding is r = 0.05. a. (6) Calculate the expected value of the stock price in three months from today. b. (8) Calculate the variance of the stock price in three months from today. c. (8) What is the probability that the stock price will be at least 108 in three months from today? d. (8) Find the price of a European call option written on this stock whose strike price is K = 103 and which expires in three months from today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts