Question: Q1: ABC company is evaluating a project proposal which is expected to have a life of 10 years. The project proposal under consideration requires an

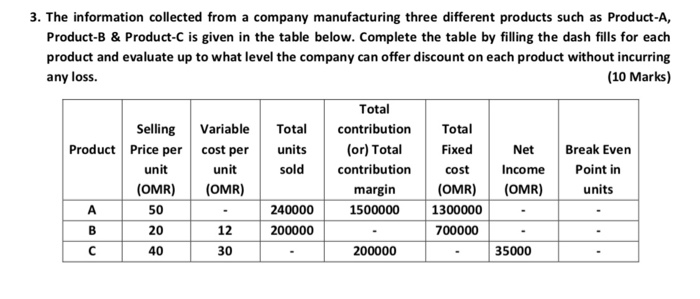

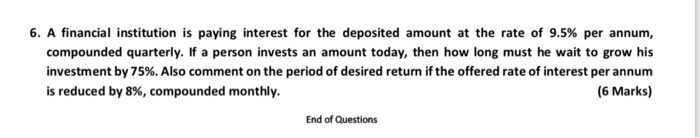

3. The information collected from a company manufacturing three different products such as Product-A, Product-B & Product-C is given in the table below. Complete the table by filling the dash fills for each product and evaluate up to what level the company can offer discount on each product without incurring any loss. (10 Marks) Total Selling Variable Total contribution Total Product Price per cost per units (or) Total Fixed Net Break Even unit unit sold contribution cost Income Point in (OMR) (OMR) margin (OMR) (OMR) units 50 240000 1500000 1300000 B 12 200000 700000 30 200000 35000 20 40 6. A financial institution is paying interest for the deposited amount at the rate of 9.5% per annum, compounded quarterly. If a person invests an amount today, then how long must he wait to grow his investment by 75%. Also comment on the period of desired return if the offered rate of interest per annum is reduced by 8%, compounded monthly. (6 Marks) End of Questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts