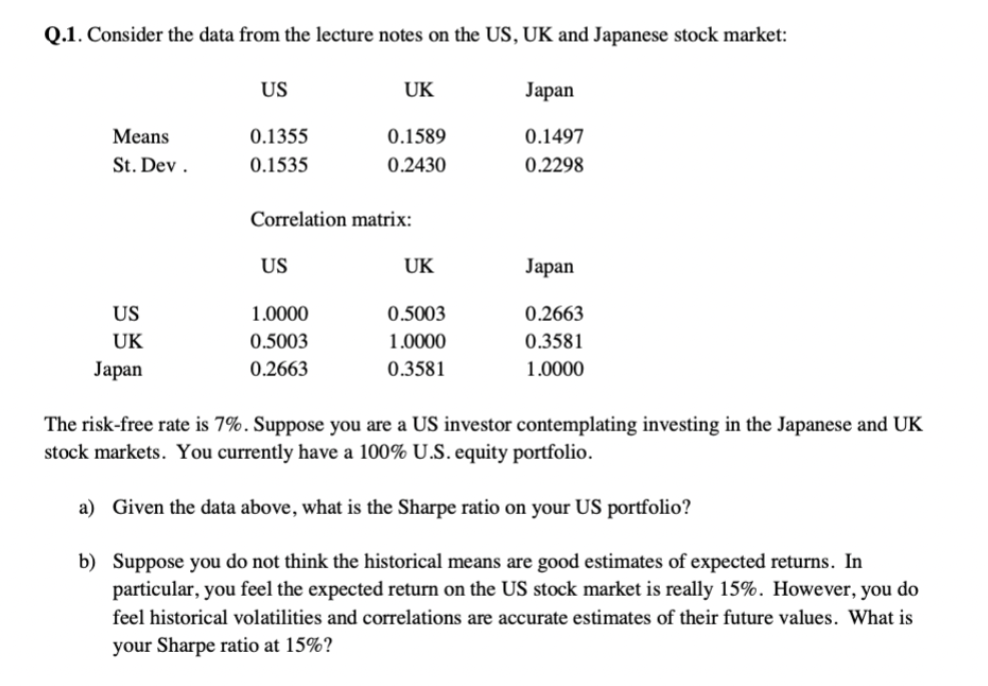

Question: Q.1. Consider the data from the lecture notes on the US, UK and Japanese stock market: US UK Japan Means St. Dev. 0.1355 0.1535 0.1589

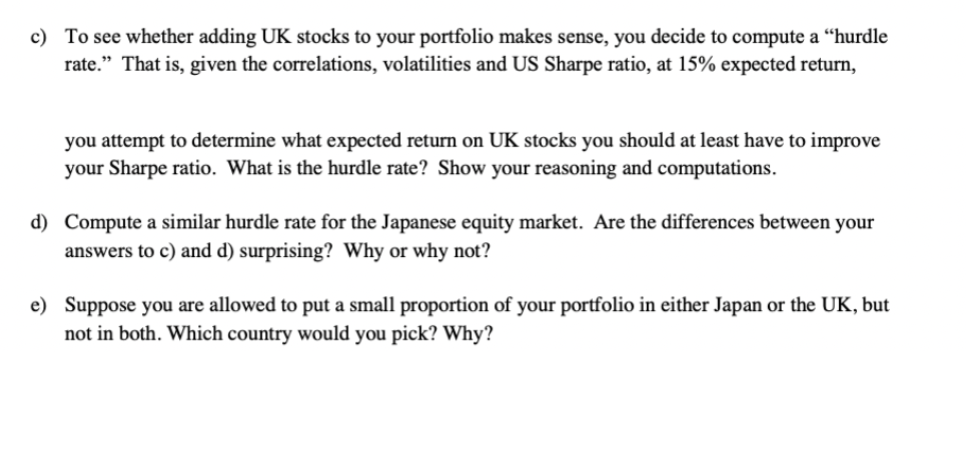

Q.1. Consider the data from the lecture notes on the US, UK and Japanese stock market: US UK Japan Means St. Dev. 0.1355 0.1535 0.1589 0.2430 0.1497 0.2298 Correlation matrix: US UK Japan US UK Japan 1.0000 0.5003 0.2663 0.5003 1.0000 0.3581 0.2663 0.3581 1.0000 The risk-free rate is 7%. Suppose you are a US investor contemplating investing in the Japanese and UK stock markets. You currently have a 100% U.S. equity portfolio. a) Given the data above, what is the Sharpe ratio on your US portfolio? b) Suppose you do not think the historical means are good estimates of expected returns. In particular, you feel the expected return on the US stock market is really 15%. However, you do feel historical volatilities and correlations are accurate estimates of their future values. What is your Sharpe ratio at 15%? c) To see whether adding UK stocks to your portfolio makes sense, you decide to compute a hurdle rate. That is, given the correlations, volatilities and US Sharpe ratio, at 15% expected return, you attempt to determine what expected return on UK stocks you should at least have to improve your Sharpe ratio. What is the hurdle rate? Show your reasoning and computations. d) Compute a similar hurdle rate for the Japanese equity market. Are the differences between your answers to c) and d) surprising? Why or why not? e) Suppose you are allowed to put a small proportion of your portfolio in either Japan or the UK, but not in both. Which country would you pick? Why? Q.1. Consider the data from the lecture notes on the US, UK and Japanese stock market: US UK Japan Means St. Dev. 0.1355 0.1535 0.1589 0.2430 0.1497 0.2298 Correlation matrix: US UK Japan US UK Japan 1.0000 0.5003 0.2663 0.5003 1.0000 0.3581 0.2663 0.3581 1.0000 The risk-free rate is 7%. Suppose you are a US investor contemplating investing in the Japanese and UK stock markets. You currently have a 100% U.S. equity portfolio. a) Given the data above, what is the Sharpe ratio on your US portfolio? b) Suppose you do not think the historical means are good estimates of expected returns. In particular, you feel the expected return on the US stock market is really 15%. However, you do feel historical volatilities and correlations are accurate estimates of their future values. What is your Sharpe ratio at 15%? c) To see whether adding UK stocks to your portfolio makes sense, you decide to compute a hurdle rate. That is, given the correlations, volatilities and US Sharpe ratio, at 15% expected return, you attempt to determine what expected return on UK stocks you should at least have to improve your Sharpe ratio. What is the hurdle rate? Show your reasoning and computations. d) Compute a similar hurdle rate for the Japanese equity market. Are the differences between your answers to c) and d) surprising? Why or why not? e) Suppose you are allowed to put a small proportion of your portfolio in either Japan or the UK, but not in both. Which country would you pick? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts