Question: Quantum Inc. does not pay dividends on its stock currently. It is expected to pay its first dividend of s5 at the end of two

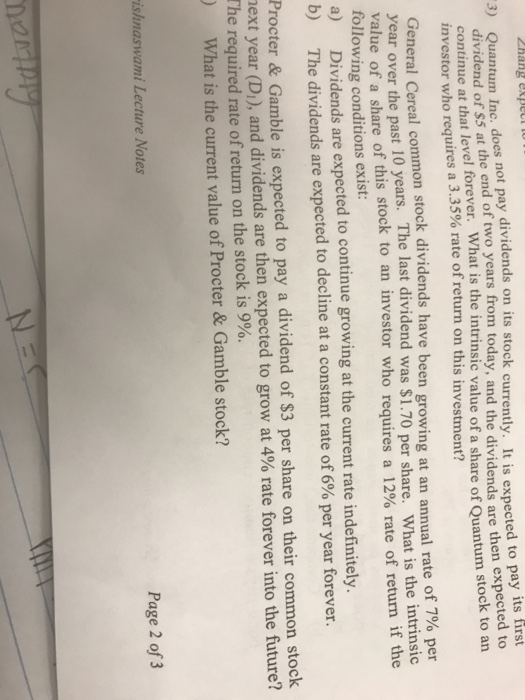

Quantum Inc. does not pay dividends on its stock currently. It is expected to pay its first dividend of s5 at the end of two years from today, and the dividends are then expected to 3) continue at that level investor who requi ver. What is the intrinsic value of a share of Quantum s res a 3.35% rate of return on this investment? tock to an General Cereal common stock dividends have been growing at an ann year over the past 10 years. The last dividend was ual rate of7% per $1.70 per share. What is the intrinsic value of a share of this stock to an investor who requires a 12% rate of return if the following conditions exist: a) b) Dividends are expected to continue growing at the current rate indefinitely. The dividends are expected to decline at a constant rate of 6% per year forever. Procter &Gamble is expected to pay a dividend of $3 per share on their common stock ext year (D), and dividends are then expected to grow at 4% rate forever into the future? The required rate of return on the stock is 9%. What is the current value of Procter& Gamble stock? ishnaswami Lecture Notes Page 2 of 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts