Question: QUESTION 1 10 points Save Answer Your boss decides that interest rates are going to change tomorrow, and change BIG. That is to say, interest

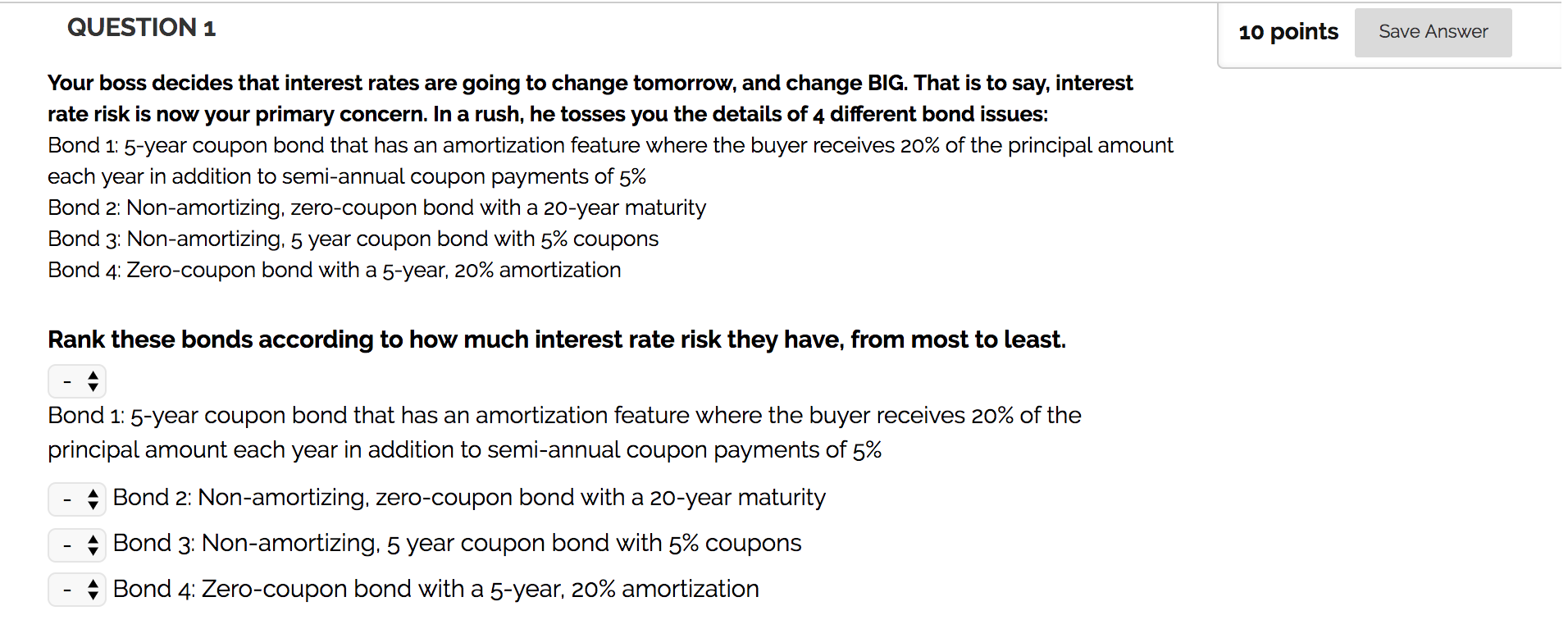

QUESTION 1 10 points Save Answer Your boss decides that interest rates are going to change tomorrow, and change BIG. That is to say, interest rate risk is now your primary concern. In a rush, he tosses you the details of 4 different bond issues: Bond 1: 5-year coupon bond that has an amortization feature where the buyer receives 20% of the principal amount each year in addition to semi-annual coupon payments of 5% Bond 2: Non-amortizing, zero-coupon bond with a 20-year maturity Bond 3: Non-amortizing, 5 year coupon bond with 5% coupons Bond 4: Zero-coupon bond with a 5-year, 20% amortization Rank these bonds according to how much interest rate risk they have, from most to least. Bond 1: 5-year coupon bond that has an amortization feature where the buyer receives 20% of the principal amount each year in addition to semi-annual coupon payments of 5% - A Bond 2: Non-amortizing, zero-coupon bond with a 20-year maturity - A Bond 3: Non-amortizing. 5 year coupon bond with 5% coupons - Bond 4: Zero-coupon bond with a 5-year, 20% amortization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts