Question: Question 1 (15 Marks) John was your friend. When he got married and had a kid eight years ago, he consulted with you and purchased

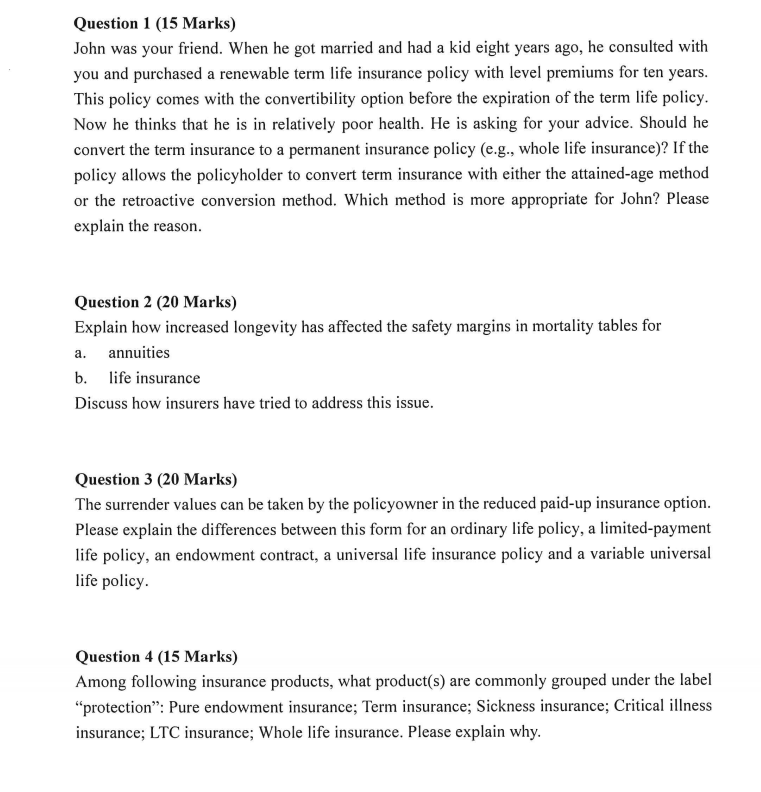

Question 1 (15 Marks) John was your friend. When he got married and had a kid eight years ago, he consulted with you and purchased a renewable term life insurance policy with level premiums for ten years. This policy comes with the convertibility option before the expiration of the term life policy. Now he thinks that he is in relatively poor health. He is asking for your advice. Should he convert the term insurance to a permanent insurance policy (e.g., whole life insurance)? If the policy allows the policyholder to convert term insurance with either the attained-age method or the retroactive conversion method. Which method is more appropriate for John? Please explain the reason. Question 2 (20 Marks) Explain how increased longevity has affected the safety margins in mortality tables for a. annuities b. life insurance Discuss how insurers have tried to address this issue. Question 3 (20 Marks) The surrender values can be taken by the policyowner in the reduced paid-up insurance option. Please explain the differences between this form for an ordinary life policy, a limited-payment life policy, an endowment contract, a universal life insurance policy and a variable universal life policy. Question 4 (15 Marks) Among following insurance products, what product(s) are commonly grouped under the label "protection: Pure endowment insurance; Term insurance; Sickness insurance; Critical illness insurance; LTC insurance; Whole life insurance. Please explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts