Question: Question 1 25 pts You have just become the Treasurer/CFO of a company. The company's Director of Sales comes in to your office and tells

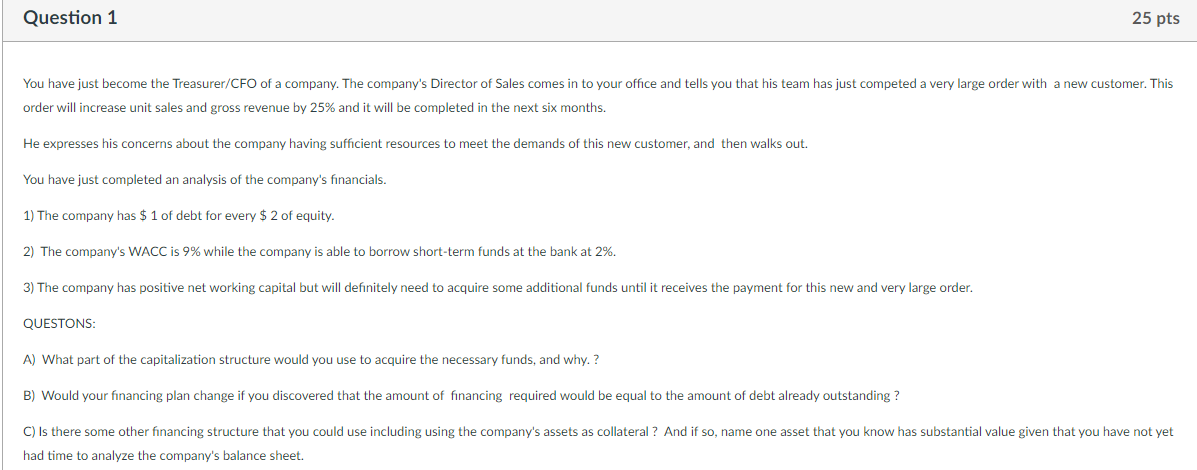

Question 1 25 pts You have just become the Treasurer/CFO of a company. The company's Director of Sales comes in to your office and tells you that his team has just competed a very large order with a new customer. This order will increase unit sales and gross revenue by 25% and it will be completed in the next six months. He expresses his concerns about the company having sufficient resources to meet the demands of this new customer, and then walks out. You have just completed an analysis of the company's financials. 1) The company has $ 1 of debt for every $ 2 of equity. 2) The company's WACC is 9% while the company is able to borrow short-term funds at the bank at 2%. 3) The company has positive net working capital but will definitely need to acquire some additional funds until it receives the payment for this new and very large order. QUESTONS: A) What part of the capitalization structure would you use to acquire the necessary funds, and why? B) Would your financing plan change if you discovered that the amount of financing required would be equal to the amount of debt already outstanding ? C) Is there some other financing structure that you could use including using the company's assets as collateral ? And if so, name one asset that you know has substantial value given that you have not yet had time to analyze the company's balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts