Question: QUESTION 1. Consider a three year bond with face value $ 10, 000, 000 which pays semi-annual coupons at a rate c. Assume there

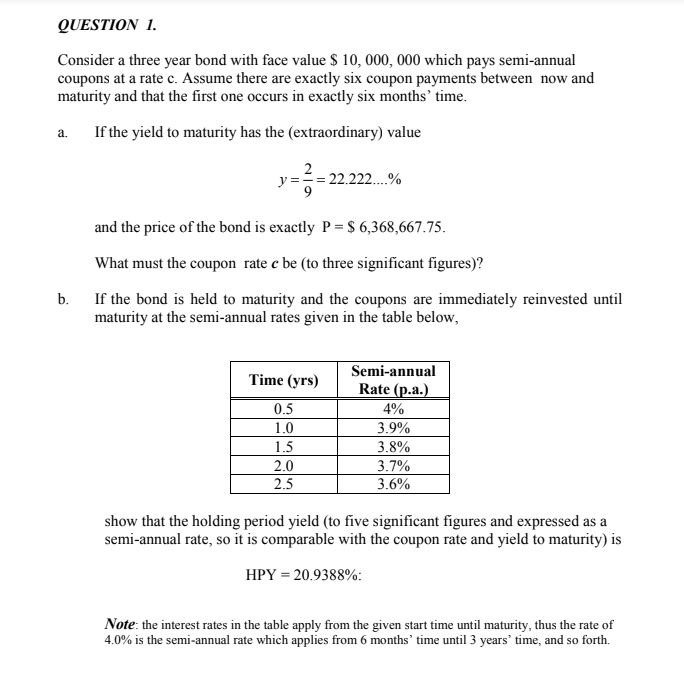

QUESTION 1. Consider a three year bond with face value $ 10, 000, 000 which pays semi-annual coupons at a rate c. Assume there are exactly six coupon payments between now and maturity and that the first one occurs in exactly six months' time. If the yield to maturity has the (extraordinary) value a. 2 y === 22.222..% 9 and the price of the bond is exactly P = $ 6,368,667.75. What must the coupon rate c be (to three significant figures)? b. If the bond is held to maturity and the coupons are immediately reinvested until maturity at the semi-annual rates given in the table below, Time (yrs) 0.5 1.0 1.5 2.0 2.5 Semi-annual Rate (p.a.) 4% 3.9% 3.8% 3.7% 3.6% show that the holding period yield (to five significant figures and expressed as a semi-annual rate, so it is comparable with the coupon rate and yield to maturity) is HPY = 20.9388%: Note: the interest rates in the table apply from the given start time until maturity, thus the rate of 4.0% is the semi-annual rate which applies from 6 months' time until 3 years' time, and so forth.

Step by Step Solution

There are 3 Steps involved in it

1 a Given Face value 10000000 Number of coupon payments 6 every 6 months f... View full answer

Get step-by-step solutions from verified subject matter experts