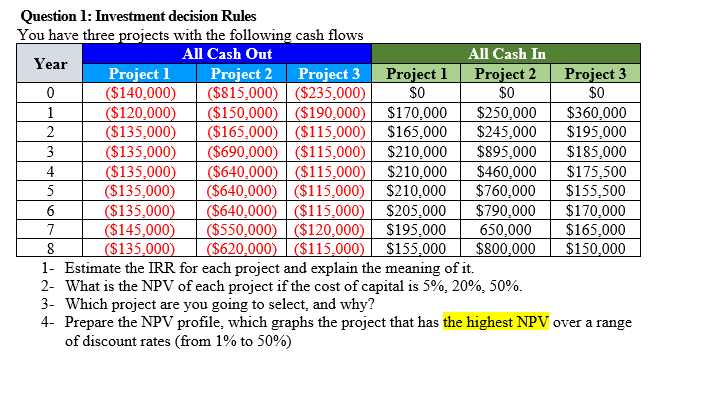

Question: Question 1: Investment decision Rules You have three projects with the following cash flows All Cash Out All Cash In Year Project 1 Project 2

Question 1: Investment decision Rules You have three projects with the following cash flows All Cash Out All Cash In Year Project 1 Project 2 Project 3 Project 1 Project 2 Project 3 ($140,000) ($815,000) ($235,000) $0 $0 $0 ($120,000) ($150,000) ($190,000 $170,000 $250,000 $360,000 ($135,000) ($165,000) ($115,000 $165,000 $245,000 $195,000 ($135,000) ($690,000) ($115,000) $210.000 $895,000 $185,000 ($135,000) ($640,000) ($115,000 $210,000 $460,000 $175,500 ($135,000) ($640,000) ($115,000) $210,000 $760,000 $155,500 ($135,000) ($640,000) ($115,000) $205,000 $790,000 $170,000 ($145,000) $550,000) ($120,000) $195,000 650,000 $165,000 8 ($135,000) ($620.000) ($115,000 $155.000 $800,000 $150,000 1- Estimate the IRR for each project and explain the meaning of it. 2- What is the NPV of each project if the cost of capital is 5%, 20%, 50%. 3- Which project are you going to select, and why? 4- Prepare the NPV profile, which graphs the project that has the highest NPV over a range of discount rates (from 1% to 50%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts