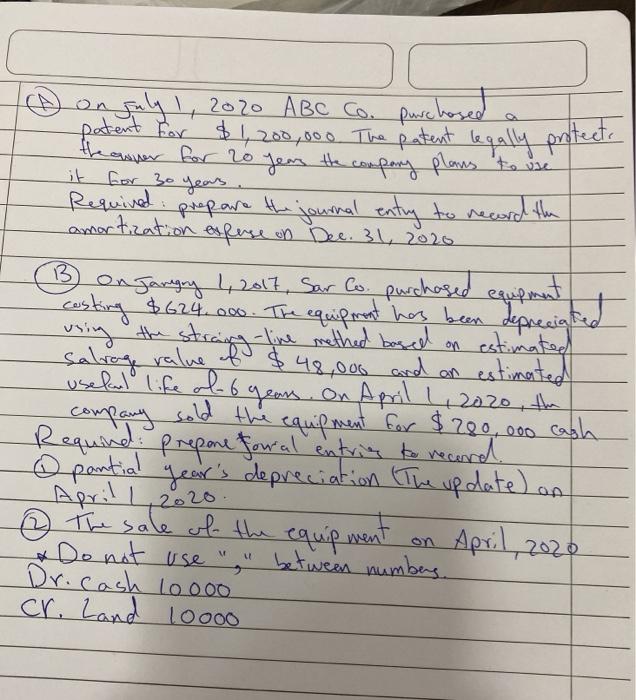

Question: Question 11 4 points e Ant A. On July 1, 2020 ABC Co purchased a patent for $ 1.200.000 TH palgally protects the one for

Question 11 4 points e Ant A. On July 1, 2020 ABC Co purchased a patent for $ 1.200.000 TH palgally protects the one for 20 years the company plans to use it for 30 years Required:Prepare the journal try to record the motion expense on Dec 31, 2020 B. On January 1, 2017, Sa Co purchased equipment costing 5624000 The equipment has been depreciated using the right line method and on a salvage alue of $48.000 and an estimated useful life of 6 years on April 1, 2020, the company sold the quiet for 200.000 ch Required. Prepare journal entries to record 1 The partial year's depreciation (die update on April 2020 2. The sale of the comment on April 1.2020 YOUR ANSWER SHOULD BE IN THE FOLLOWING PORN DO NOT USE MBETWEEN NUMBERS Dy. Cash 10000 Cr Land 10000 For the toolbar.press ALT+F10 (PC) O ALTFN+F10(Mac) B IUS Paragraph Arial M14px IX 11: 2 it for 30 years B onguly 1, 2020 ABC Co. purchased partent For $1,200,000 The patent legaly protect the apper for 20 years the company plans to use Required prepare the journal entry to record the amortization expense on Dec. 31, 2020 engary 4 2017. Sar.Co purchased equipment casting $624.000. The equipment has been depreciated using the strips Licen thed based on estimated useful life of 6 years. On April 1, 2020, the company sold the equipment for $200,000 cash Requind prepare forral entring to record pantial year's depreciation (The up date) an April 1, 2020 The sale of the equipment & Do not use " " between numbers Dr. cash 10000 cr. Land 10000 April, 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts