Question: Question 11 Given all the above information and your previous solutions, if you were to invest 40% and 60% in B, what would be the

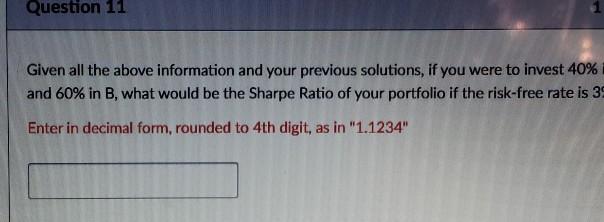

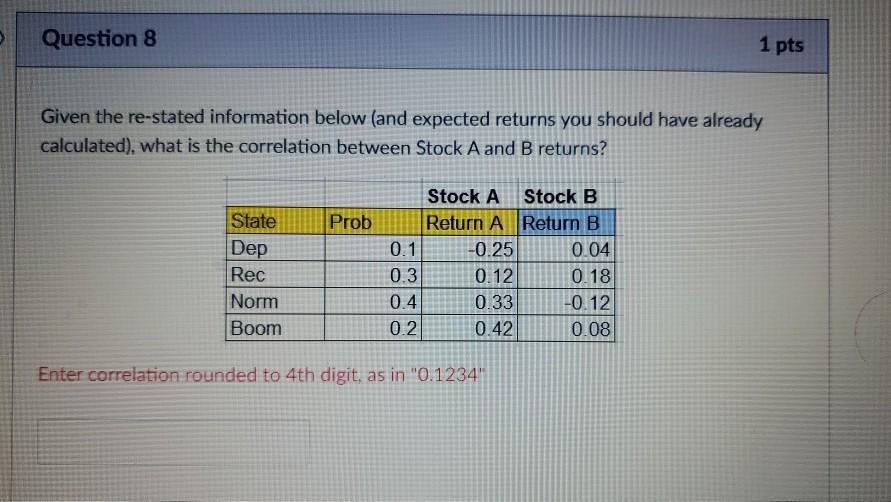

Question 11 Given all the above information and your previous solutions, if you were to invest 40% and 60% in B, what would be the Sharpe Ratio of your portfolio if the risk-free rate is 3 Enter in decimal form, rounded to 4th digit, as in "1.1234" Question 8 1 pts Given the re-stated information below (and expected returns you should have already calculated), what is the correlation between Stock A and B returns? Prob State Dep Rec Norm Boom Stock A Stock B Return A Return B 0.1 -0.25 0.04 0.3 0.12 0.18 0.4 0.33 -0.12 0.2 0.42 0.08 Enter correlation rounded to 4th digit, as in "0.1234 Question 11 Given all the above information and your previous solutions, if you were to invest 40% and 60% in B, what would be the Sharpe Ratio of your portfolio if the risk-free rate is 3 Enter in decimal form, rounded to 4th digit, as in "1.1234" Question 8 1 pts Given the re-stated information below (and expected returns you should have already calculated), what is the correlation between Stock A and B returns? Prob State Dep Rec Norm Boom Stock A Stock B Return A Return B 0.1 -0.25 0.04 0.3 0.12 0.18 0.4 0.33 -0.12 0.2 0.42 0.08 Enter correlation rounded to 4th digit, as in "0.1234

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts