Question: QUESTION 12 Use the data below for questions 11 to 15 (among the 4 options in each multiple choice, choose the one that is equal,

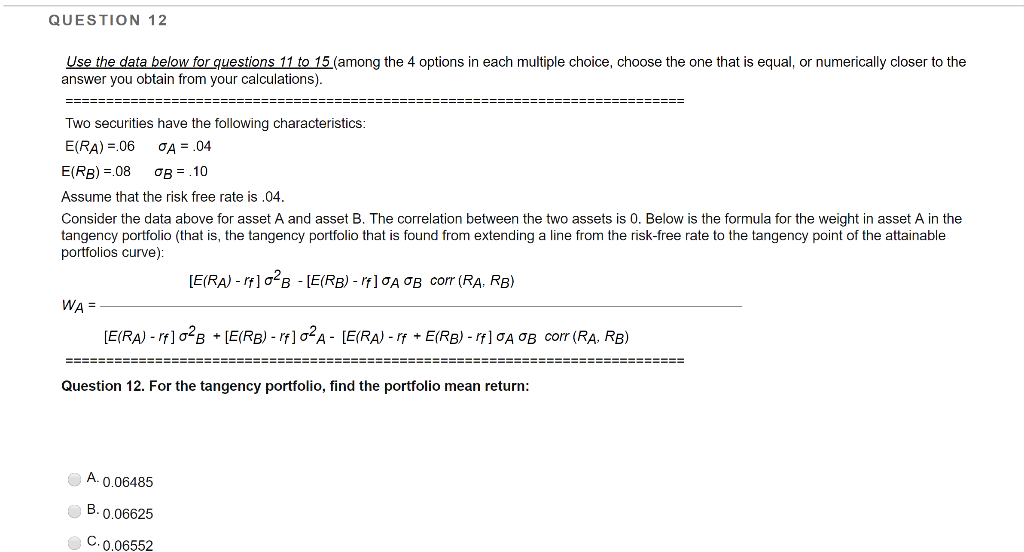

QUESTION 12 Use the data below for questions 11 to 15 (among the 4 options in each multiple choice, choose the one that is equal, or numerically closer to the answer you obtain from your calculations). == === ======== ===== ===== = ========= ==== ====== == ========= === ======== ========== = TWO securities have the following characteristics: E(RA) = 06 OA = .04 E(RB) = 08 08 = 10 Assume that the risk free rate is .04. Consider the data above for asset A and asset B. The correlation between the two assets is 0. Below is the formula for the weight in asset A in the tangency portfolio (that is, the tangency portfolio that is found from extending a line from the risk-free rate to the tangency point of the attainable portfolios curve): [E(RA) - If] 02B - [E(RB) - 16]OA OB corr (RA, RB) WA=- [E(RA) - r*] 028 + [E(RB) - rf] OP A- [E(RA) - rf + E(RB) - rf] CA OB corr (RA, RB) ============================================================================ Question 12. For the tangency portfolio, find the portfolio mean return: A. 0.06485 B. 0.06625 C.0.06552

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts