Question: Question 15 4 pts When a firm makes bad managerial judgments or has unforeseen negative events happen to it that affects its returns; these random

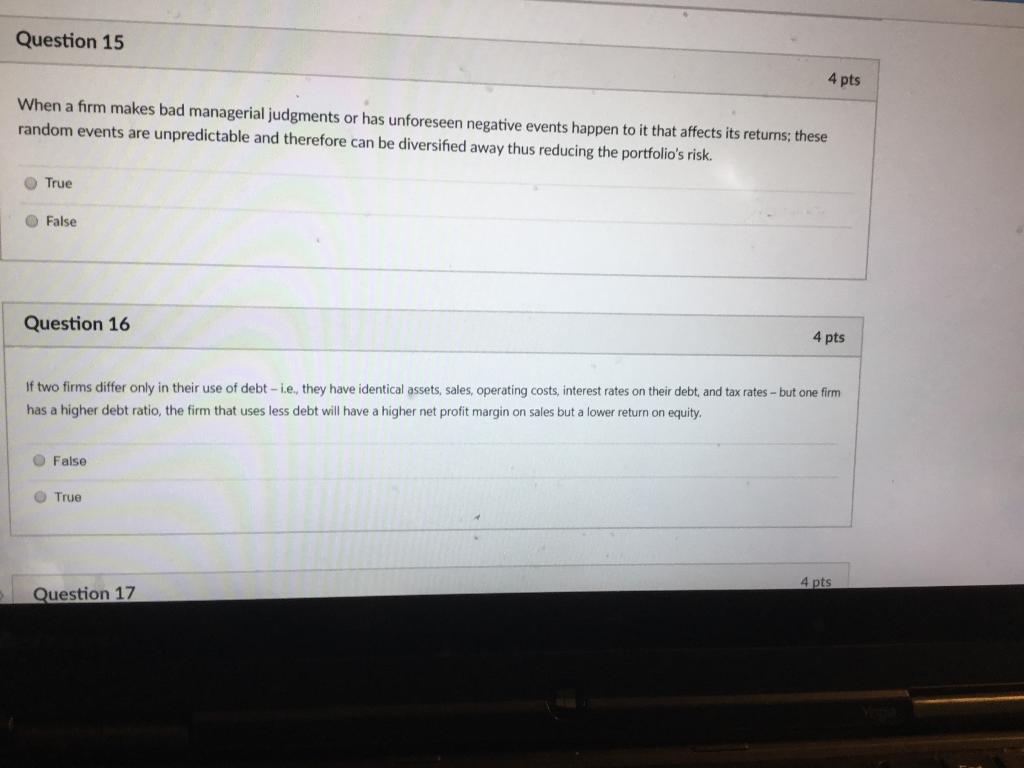

Question 15 4 pts When a firm makes bad managerial judgments or has unforeseen negative events happen to it that affects its returns; these random events are unpredictable and therefore can be diversified away thus reducing the portfolio's risk. True False Question 16 4 pts If two firms differ only in their use of debt - ie, they have identical assets, sales, operating costs, interest rates on their debt and tax rates - but one firm has a higher debt ratio, the firm that uses less debt will have a higher net profit margin on sales but a lower return on equity. False True 4 pts Question 17 Question 15 4 pts When a firm makes bad managerial judgments or has unforeseen negative events happen to it that affects its returns; these random events are unpredictable and therefore can be diversified away thus reducing the portfolio's risk. True False Question 16 4 pts If two firms differ only in their use of debt - ie, they have identical assets, sales, operating costs, interest rates on their debt and tax rates - but one firm has a higher debt ratio, the firm that uses less debt will have a higher net profit margin on sales but a lower return on equity. False True 4 pts Question 17

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts