Question: Question 16 5 points Save Answer Buttercup, Inc. has a beta of 1.4, the market risk premium is 6.2%, and the risk free rate is

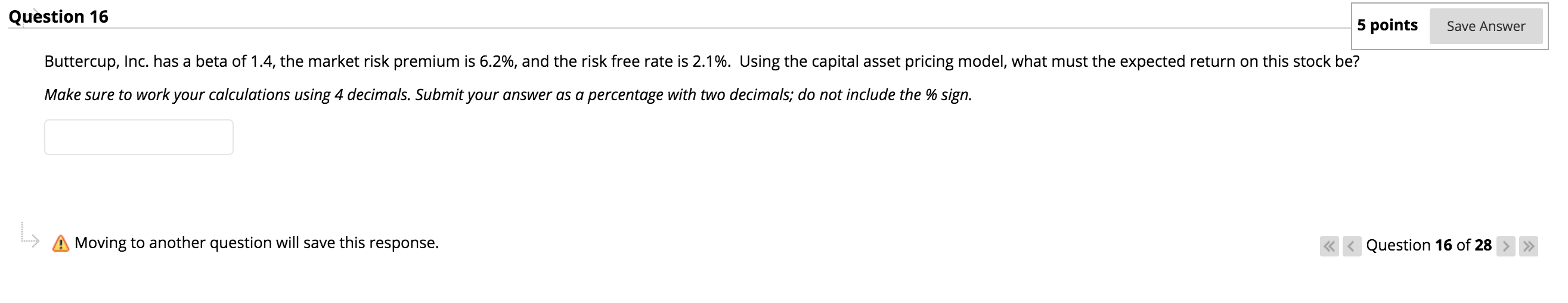

Question 16 5 points Save Answer Buttercup, Inc. has a beta of 1.4, the market risk premium is 6.2%, and the risk free rate is 2.1%. Using the capital asset pricing model, what must the expected return on this stock be? Make sure to work your calculations using 4 decimals. Submit your answer as a percentage with two decimals; do not include the % sign. > A Moving to another question will save this response. >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts