Question: question 19-20 18. A pension fund manager is considering three mutual fiunds, the stock fund, the bond fund and a T-bill money market fund that

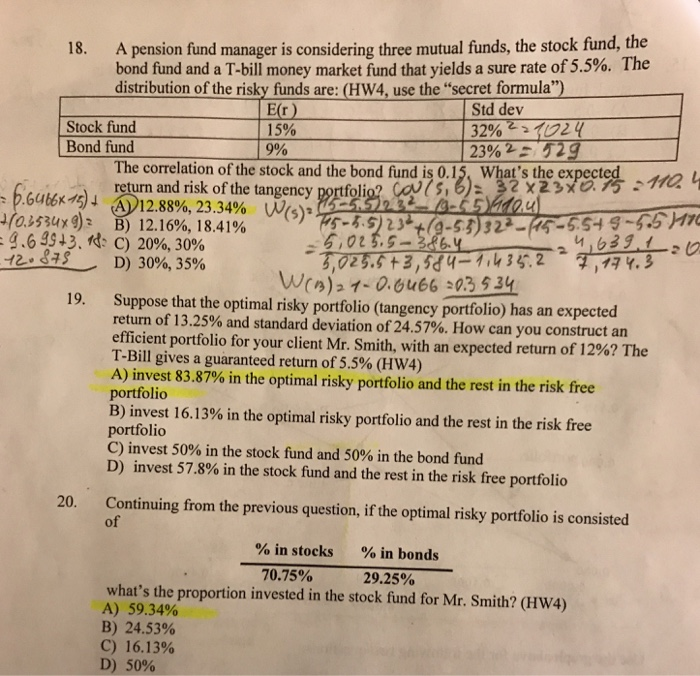

18. A pension fund manager is considering three mutual fiunds, the stock fund, the bond fund and a T-bill money market fund that yields a sure rate of5.5%. The distribution of the risky funds are: (HW4, use the "secret formula") Std dev Stock fund Bond fund Er) 15% 9% The correlation of the stock and the bond fund is 0.15, What's the expected return and risk of the tangency portfoli 110 4 1(03534x g): B) 12.16%, 18.41% ,02 3.9-36 6 3s+3. d: C) 20%, 30% 12, eu-D) 30%, 35% 19. Suppose that the optimal risky portfolio (tangency portfolio) has an expected return of 13.25% and standard deviation of 24.57%. How can you construct an efficient portfolio for your client Mr. Smith, with an expected return of 12%? The T-Bill gives a guaranteed return of 5.5% (Hwa) A) invest 83.87% in the optimal risky portfolio and the rest in the risk free portfolio B) invest 16.13% in the optimal risky portfolio and the rest in the risk free portfolio C) invest 50% in the stock fund and 50% in the bond fund D) invest 57.8% in the stock fund and the rest in the risk free portfolio Continuing from the previous question, if the optimal risky portfolio is consisted of 20. % in stocks 70.75% % in bonds 29.25% what's the proportion invested in the stock fund for Mr. Smith? (Hw4) A) 59.34% B) 24.53% C) 16.13% D) 50%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts