Question: 5 7 2 Please try to answer within 30 minutes not 3 days later. Consider the single factor APT. Portfolio A has a beta of

5

7

2

Please try to answer within 30 minutes not 3 days later.

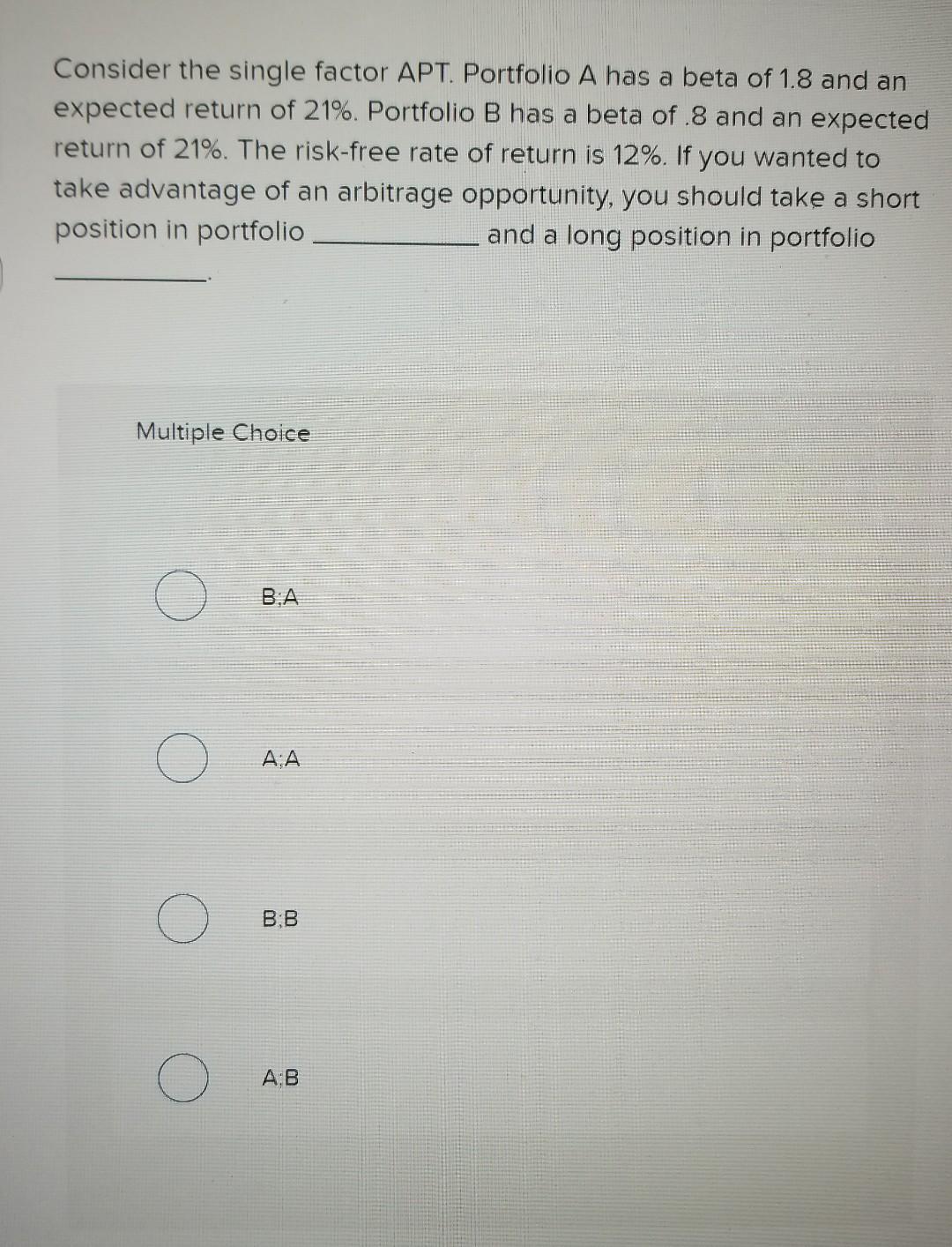

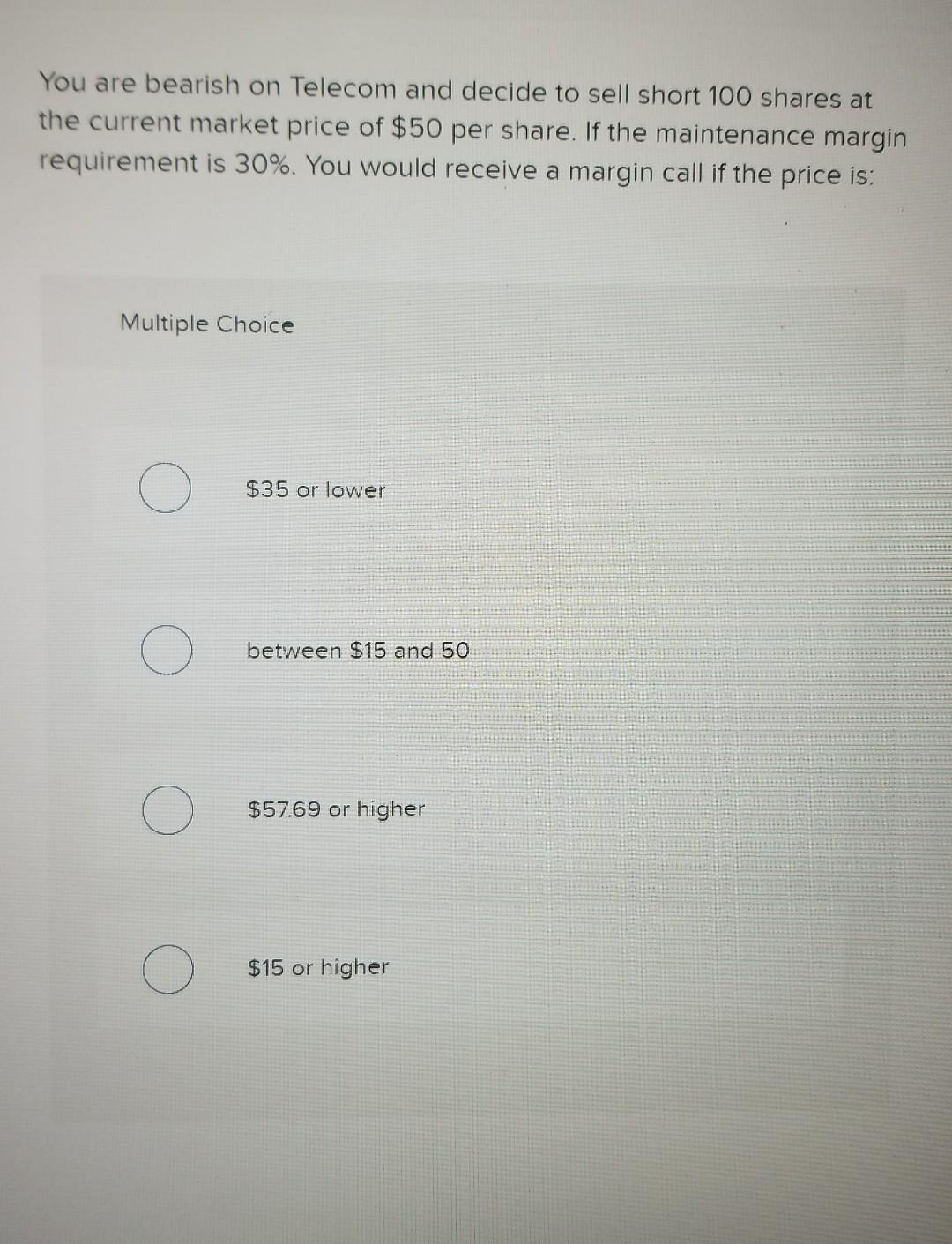

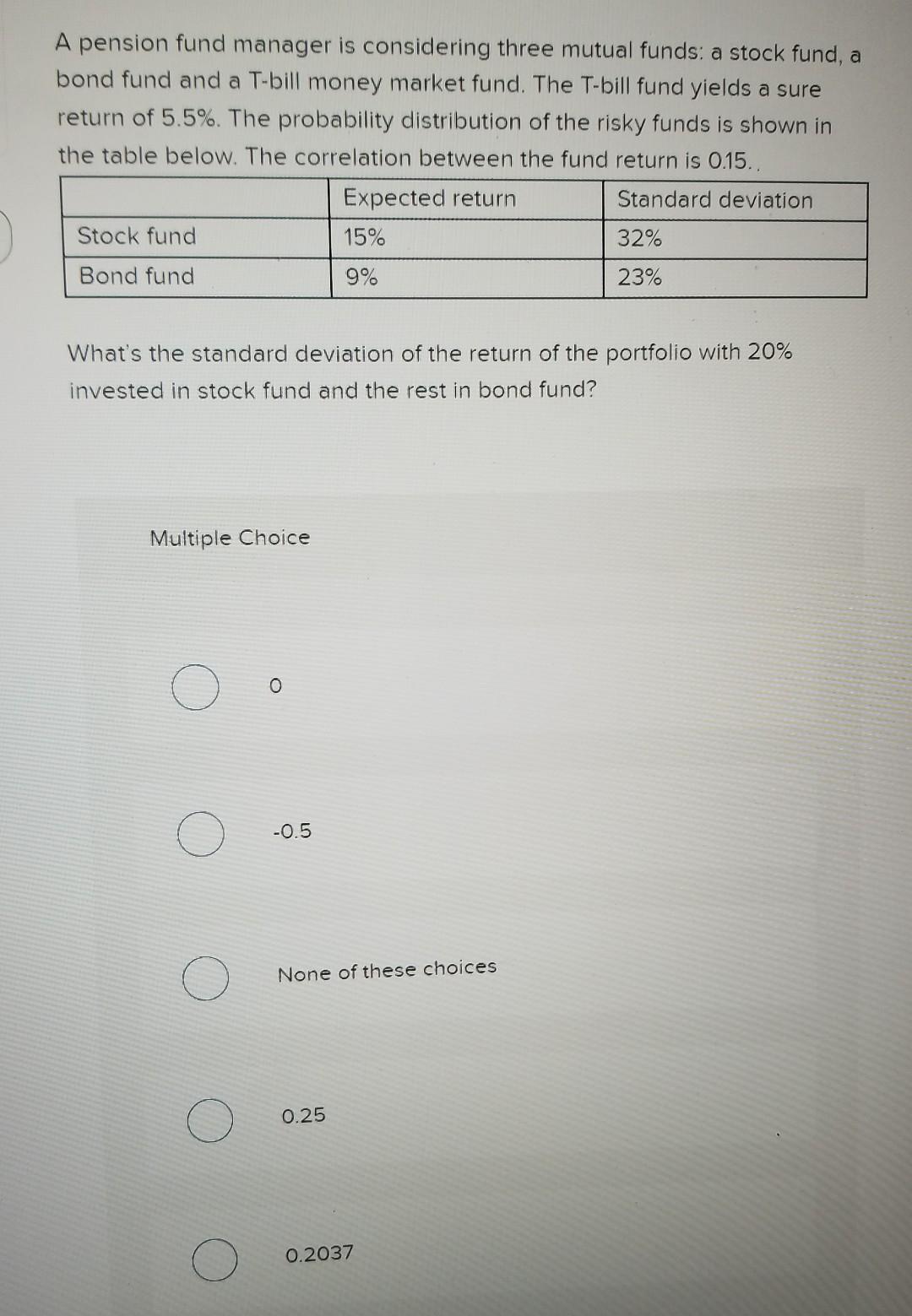

Consider the single factor APT. Portfolio A has a beta of 1.8 and an expected return of 21%. Portfolio B has a beta of 8 and an expected return of 21%. The risk-free rate of return is 12%. If you wanted to take advantage of an arbitrage opportunity, you should take a short position in portfolio and a long position in portfolio Multiple Choice : ( AA : ( ) A:B You are bearish on Telecom and decide to sell short 100 shares at the current market price of $50 per share. If the maintenance margin requirement is 30%. You would receive a margin call if the price is: Multiple Choice $35 or lower between $15 and 50 $57.69 or higher $15 or higher A pension fund manager is considering three mutual funds: a stock fund, a bond fund and a T-bill money market fund. The T-bill fund yields a sure return of 5.5%. The probability distribution of the risky funds is shown in the table below. The correlation between the fund return is 0.15.. Expected return Standard deviation Stock fund 15% 32% Bond fund 9% 23% What's the standard deviation of the return of the portfolio with 20% invested in stock fund and the rest in bond fund? Multiple Choice 0 -0.5 None of these choices 0.25 0.2037

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts